Ian Spectre was reminiscing with James Fortescue-Simmonds over a cup of tea. They talked about how they had introduced Public Sector IR35 and then exempted HMRC to keep costs down. Of course Ian Spectre had benefited because he used a personal service company.

A number of other large public departments had also claimed an exemption for fear that they wouldn’t be able to complete their IT projects on time and to budget. So Public Sector IR35 had not generated as much cash as they had hoped. But at least they got the medics and teachers. Tens of thousands of NHS consultant, pharmacists and people involved in education could no longer avoid PAYE or claim travelling expenses while working at remote locations on short term assignments. Not only had the Treasury collected more taxes but less was being spent on the NHS and education because many individuals over 55 had simply retired rather than pay extra tax. As Spectre had said at the time, some people will die and some kids will have sub-standard education, but so what?

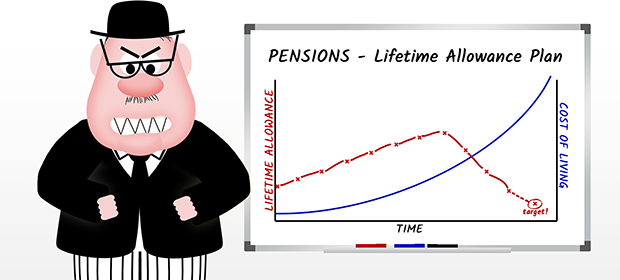

Another cunning scheme Spectre had come up with involved pensions. The project had been ongoing for over 10 years. The purpose was to ambush anyone who wanted to build up a half decent pension scheme and tax them to the hilt. Those in defined benefit schemes were the most likely to fall victim. Spectre’s planning was meticulously thought out and involved several steps.

- He would introduce a generous lifetime allowance and annual allowance.

- These allowances would be allowed to increase to counter the effects of inflation.

- There would then be steep reductions of these allowances over a 3 year period with the annual allowance dropping to £40,000.

- To mitigate the effect of the reduction in the annual allowance, tax payers would be allowed to carry forward unused annual allowance for up to 3 years.

- Tapering of the annual allowance would be introduced where a person’s income exceeded £110,000 and their income and pension input exceeded £150,000 in total so that when that total reached £210,000 the annual allowance would be just £10,000.

******************************

Some two months before the meeting between Spectre and Fortescue-Simmonds, Steve Jones and Sunil Patel had been talking about tax and pensions in the canteen at the Fawkes Memorial Hospital. Both men were 50 years old. Steve was an NHS Trauma Consultant and Sunil was a Consultant Anaesthetist. Steve and Sunil had worked together for over 20 years and has a very good understanding of each other. They were also good friends and often socialised together. Although they were both modest there was a remarkably high survival rate amongst patients they operated on. Within FMH there were known as the “A Team”.

Sunil told Steve that he had recently had a meeting with Edward Peters at Warr & Co. Edward had explained the pension annual allowance charge to him.

“It goes like this” Sunil said, “If my total income exceeds £110,000, and my total income plus pension input exceeds £150,000, my £40,000 annual pension allowance is tapered down”.

“But surely that’s not a problem”, said Steve, “Your salary is £105,000 and you pay about 14% of that into the pension scheme”.

“It’s not that simple”, Sunil went on, “pension input is a notional amount calculated by reference to the benefits I’m building up. Last tax year my pension input was calculated as £60,000. It’s not a problem yet because I have been able to use my carry forward up till now but I don’t have any more left. My £105,000 salary is net of my pension contributions but inclusive of overtime”.

“Well at least your annual allowance won’t be tapered given that your salary is below £110,000”, Steve said cheerfully.

“It’s my total income they look at, not just my salary. I’ve got a buy-to-let. I make £5,000 a year, but because of a change they’ve made to tax relief on interest, I’m taxed as if I’ve made £6,000. Without the buy-to-let I am set to exceed my annual allowance this year by £20,000, but with it I exceed it by just over £30,000.”

“So you have to pay £4,000 tax just because you have a buy-to-let that makes you £5,000?”, Steve said incredulously. “If only”, said Sunil, “I also have to pay tax on my rental income at an effective rate of 60%. So in total I’m £2,600 out of pocket. Equivalent to a tax rate of 152% on my £5,000 actual profit.”

“So, what advice did Edward Peters give?”, asked Steve.

“Actually he gave some good pragmatic advice”, Sunil said. “I’ve agreed with my tenant that his rent is going down 50%, and he’s agreed to move out within 6 months so I can sell it. Also, taking on additional shift work is pointless so from now on just basic hours.”

“Good idea”, said Steve, “No more shift work for me either”

******************************

Spectre and Fortescue-Simmonds concluded their meeting and Fortescue-Simmonds started the 5 mile drive home. It was a cold, dark mid-January early evening. There was no let-up in the rain that had started at midday.

Half way home a 97 year old man driving a Bentley came at some speed from a side road and collided with Fortescue-Simmonds’ car sending it to the other side of the road where it was hit by a truck.

Police and paramedics were on the scene in minutes. Police Officer Walton questioned the driver of the Bentley. The nonagenarian explained that he had only had 3 G&T’s, that whilst his glasses had been left in the Rolls his vision was 20:20, and that the call he had been making on his mobile phone was a very important one about the start of the grouse shooting season just a couple of weeks away on the Glorious Twelfth. The real problem, explained the elderly gentlemen, was that he was dazzled by the reflection of the full moon from the side window of the now stationary truck on the other side of the road.

A quick thinking officer Walton had the truck driver charged with dangerous driving. He then insisted on driving the gentleman home and he arranged for the Bentley to be picked up by a reliable local garage.

Fortescue-Simmonds suffered multiple injuries and paramedics worked frantically for 30 minutes getting him from the wreckage of his car and into the ambulance which was headed straight for FMH. They radioed ahead “Get the A Team”. ETA 15 minutes from now”.

A call came to Steve Jones on his mobile. “Look, I told you that Sunil and I weren’t going to do additional shift work anymore”, Steve said, “I appreciate it’s an emergency, and you know we would help if we could, but Sunil and I have just polished off a bottle of wine you’ll have to get someone else”.

Fortescue-Simmonds was cared for by the ‘B Team’. He died at 10 pm that evening. As he was unmarried, the State saved the cost of paying his pension; which he had been due to receive in 6 months.

******************************

Officer Walton was commended for his quick thinking and decision making that day, he received an OBE, a promotion and a 50% rise in his salary. Little did he know that in 3 years’ time he too would be hit by the Pension Annual Allowance charge.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.