For most contractors, the VAT Flat Rate Scheme will be increasing to 16.5%. You need to consider de-registering from the VAT Flat Rate Scheme at the right time to minimise your losses, read on to find out how.

What is changing?

The Autumn Statement 2016 brought about a few significant changes that contractors should be aware of. Perhaps most importantly, the changes to the VAT Flat Rate Scheme. You can read our full blog on the Autumn Statement here.

HMRC has introduced a new business sub-type, called “limited cost trader”, most consultants are likely to be classified under this new sub-type. “Limited cost traders”, regardless of their occupation, will be charged 16.5% on the VAT Flat Rate Scheme as of 1st April 2017.

What is a Limited Cost Trader?

There are two ways for a business to be classified as a “limited cost trader”

- If your business spends less than 2% of VAT inclusive turnover on goods (not services) each business quarter, then you’re a “limited cost trader”.

- If your business spends more than 2% of VAT inclusive turnover on goods, but the total per quarter amounts to less than £250, then you’re a “limited cost trader”.

Example

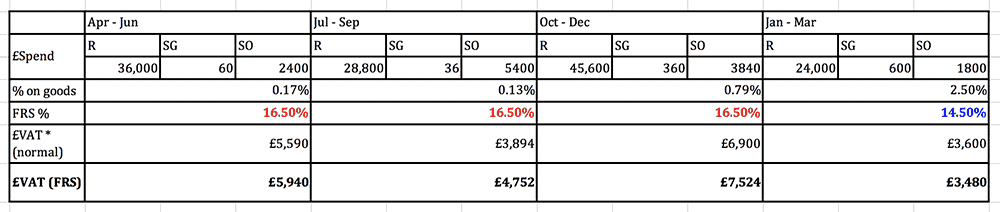

An IT Contractor working from a home office spending part of their revenue on stationery only.

R – Revenue SG – Spend on goods SO – Spend on ‘non-goods’

R – Revenue SG – Spend on goods SO – Spend on ‘non-goods’

*Please note, we have assumed 20% VAT on ‘non-goods’ for simplicity

As we can see, our IT contractor has to have a relatively poor quarterly income and an expensive stationary bill in their home office to qualify for the 14.5% they’re used to paying. In addition, they have to have a low spend on ‘non-goods’ to make the Flat Rate Scheme financially beneficial.

Please note: if you choose to remain in the VAT Flat Rate Scheme expecting a regular spend of over 2%, your overall VAT status will be evaluated every quarter. So if one quarter of the year you spend less than expected you may find that your Flat Rate for that quarter is charged at the full 16.5%.

Examples of items considered ‘goods’ are;

- Items to sell

- Supplies of gas/electricity

- Stationery

Examples of items considered not ‘goods’ are;

- Vehicles

- Fuel

- Rent

- Telephone

- IT services

How could this impact my business?

We’re going to look at three examples here comparing the 2016-2017 / 2017-2018 business year of a Business Consultant, an IT Consultant and a Freelance Photographer. We’ll show the likely outcome of their business year if they remain in the VAT Flat Rate scheme vs leaving the Scheme.

(NB: when viewing these tables on mobile, please hold your phone landscape to view correctly)

Business Consultant

| 2016 – 2017 | 2017 – 2018 | |

| Revenue | £100,000 | £100,000 |

| Spend on non-goods* | £5,600 | £5,600 |

| Spend on goods | £200 | £200 |

| FRS % | 14% | 16.5% |

| £VAT (normal) | £18,840 | £18,840 |

| £VAT (FRS) | £16,800 | £19,800 |

| FRS savings | £2,040 | £-960 |

IT Consultant

| 2016 – 2017 | 2017 – 2018 | |

| Revenue | £130,000 | £150,000 |

| Spend on non-goods* | £3,500 | £4,200 |

| Spend on goods | £50 | £70 |

| FRS % | 14.5% | 16.5% |

| £VAT (normal) | £25,290 | £29,155 |

| £VAT (FRS) | £22,620 | £29,700 |

| FRS savings | £2,670 | £-545 |

Freelance Photographer

| 2016 – 2017 | 2017 – 2018 | |

| Revenue | £50,000 | £60,000 |

| Spend on non-goods* | £6,700 | £11,500 |

| Spend on goods | £30 | £30 |

| FRS % | 11% | 16.5% |

| £VAT (normal) | £8,654 | £9,694 |

| £VAT (FRS) | £6,600 | £11,800 |

| FRS savings | £2,054 | £-2,106 |

*Please note, we have assumed 20% VAT on ‘non-goods’ for simplicity

How do I leave the Flat Rate Scheme?

Leaving the VAT Flat Rate Scheme is simply a matter of writing to HMRC at the below address and requesting that your business is removed. Please note you should indicate to HMRC the date from which you wish this to apply.

HM Revenue and Customs

Imperial House

77 Victoria Street

Grimsby

Lincolnshire

DN31 1DB

We have drafted a sample letter which can download and edit for your use here.

Please note: once you have left the scheme, you must wait 12 months if you wish to apply to re join it.

When should I make this change?

We estimate that for the most clients there will be very little difference in liability for the majority of the year. The real saving will come when a large value item or service is purchased. For example, the purchase of a new computer or the accountancy fee for preparation of your year end accounts.

If you know you have a large VATable expense in the upcoming quarter it is probably time to leave the scheme.

How can Warr & Co help?

If you’re still unsure, call us to discuss your options. If you’re not currently a client, but would like to discuss becoming a client, please call or email our team for a free no-obligation conversation about your business.

You may also be interested in our all-in-one service, Encompass. Encompass was developed to offer our clients a fixed-price solution covering as much of the business administration, tax, finances and book-keeping involved in running your own business. Think of it as a mini finance department for your consultancy.

Services include;

- Quarterly VAT returns

- Annual accounts and submissions to HMRC and Companies House

- Corporation tax

- Payroll for up to 2 employees

- Auto enrolment

- Company secretarial services, annual return, registered office service

- References

- Dividend documentation

With Encompass you’ll also have access to the award-winning cloud-based bookkeeping software, Kashflow. Ensuring you’re ahead of the curve for the changes proposed by Making Tax Digital.

In conclusion, most of our contractor accounting clients will be considered a “limited cost trader”, therefore we’re urging all contractors to consider their VAT Flat Rate Scheme status and take action as soon as possible.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.