Making Tax Digital (MTD) is here.

All VAT registered businesses must be compliant with Making Tax Digital by April 2022, this requires VAT returns to be submitted online via an approved software. Submitting a spreadsheet to the Government Gateway VAT return portal will no longer be possible from the 8th April, so any business still managing their bookkeeping in this way should update their processes. That’s why the Warr & Co team have picked out five leading providers to partner with, bringing our clients the best solutions on the market.

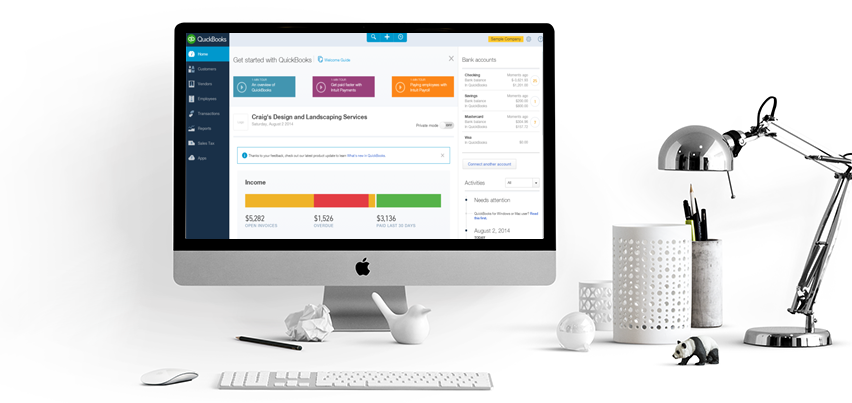

Digital accounting software will help you improve your processes and work more efficiently – let us help you make the switch from time-consuming excel spreadsheets to quick and easy cloud accounting software. Browse our chosen partners below and get in touch for a personalised recommendation.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.