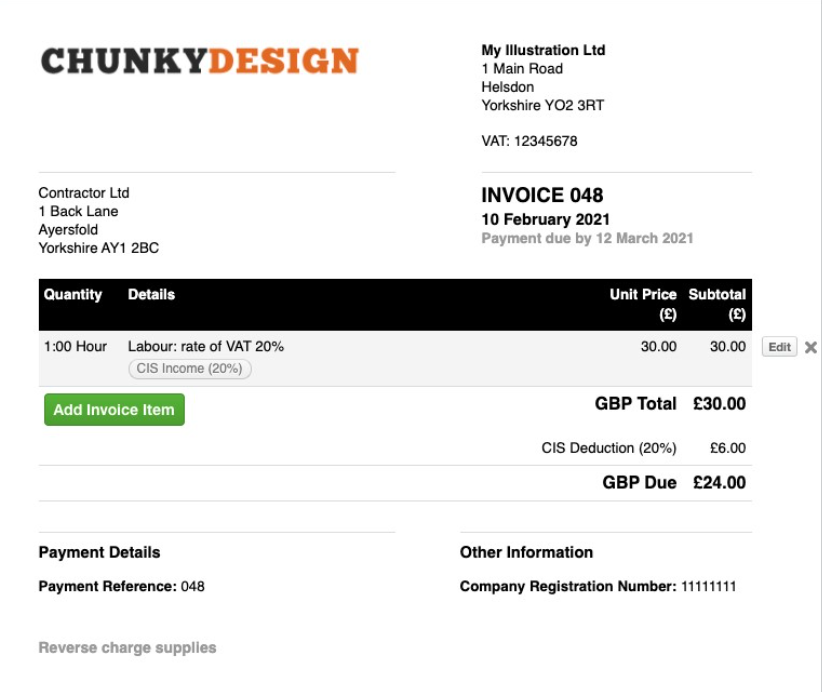

In most cases, you will now be affected by the reverse charge, and you will be required to include details of the VAT due on your invoices, but you will not receive the VAT portion of your invoice from your customer.

This does mean that you may to suffer from the loss of short term cash flow as you will no longer get the output VAT paid to you

The subcontractor must make it clear that the domestic reverse charge applies and that the customer is required to account for the VAT by noting suitable wording on the invoice such as “Reverse charge: Customer to pay VAT to HMRC” or “Reverse charge: VAT Act 1994 Section 55A applies”

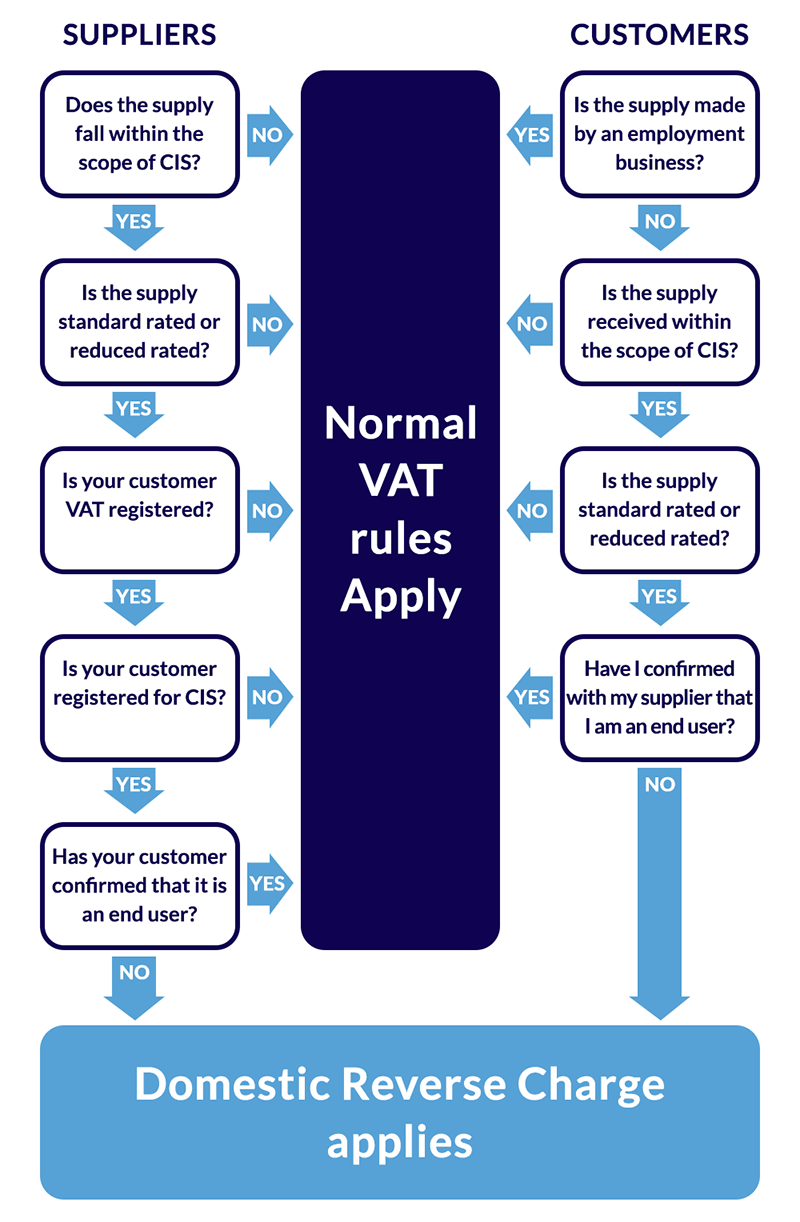

It applies only to services that are made to a contractor: it does not apply to an “end-user” customer. The subcontractor will need to be satisfied that the supply falls within the reverse charge rules and in particular that the customer is a VAT-registered contractor not an end-user. It remains to be seen what steps a subcontractor will be expected to take to verify this or what the position will be should he get it wrong.

It is expected that an end user will make it clear to the supplier that they are an end user and that VAT should be charged in the normal way instead of being reverse charged. The subcontractor should get this in a written form so that it can be retained for future reference.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.