Making Tax Digital, or ‘MTD’, is here, yet many businesses are still not prepared to go digital.

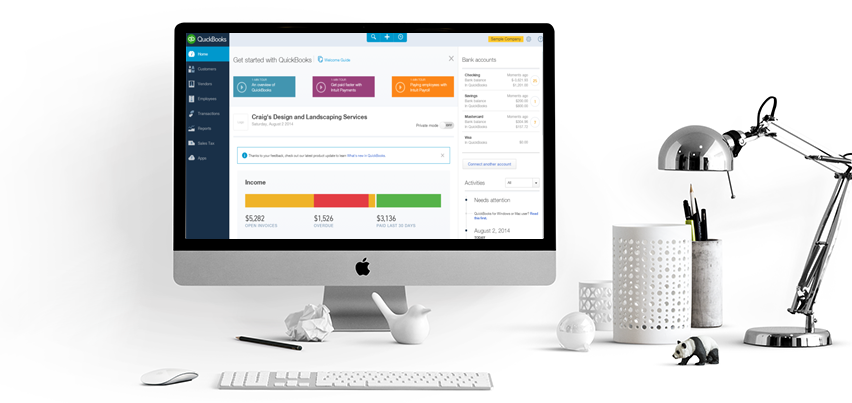

At the moment, businesses over the VAT threshold are required to submit their VAT records and payments online via a compliant cloud bookkeeping service. We’ve partnered with five compliant solutions to bring all of our clients an option that fits their business requirements.

Click below to read about our MTD bookkeeping partners and contact us to start your free trial.

Clients and non clients are invited to subscribe to our monthly newsletter. Subscribe now for our latest updates and helpful advice.