Ian Spectre has never liked spongers, especially those who get handouts from the state. The state pension has always been a particular bugbear for Spectre. He very much believes that customers should make their own provision for their retirement. However, over the years he has found little support for his views either in the Treasury or in government. Spectre knows, however, that he is right and they are wrong. None of them appreciate the huge financial burden that the state pension represents.

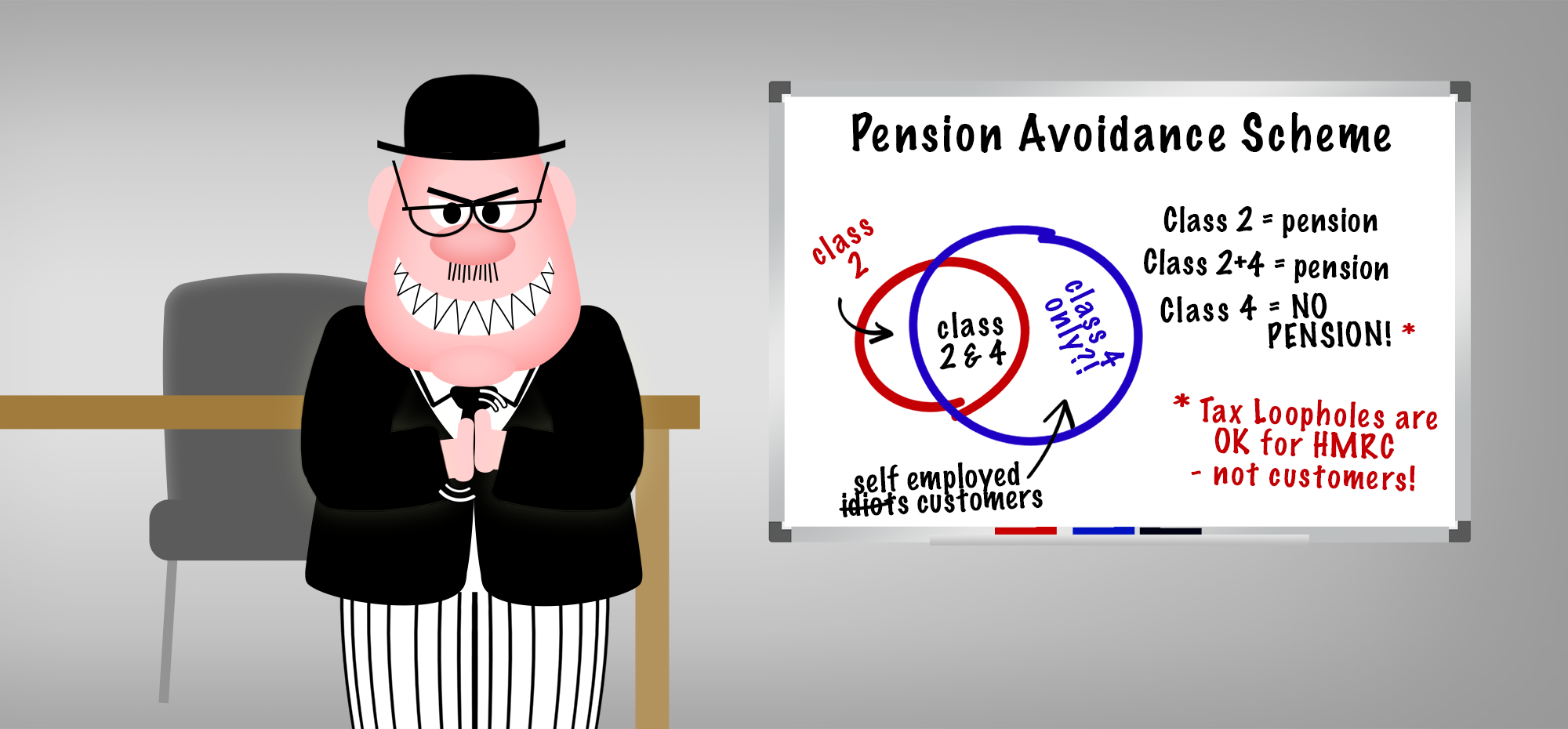

Whilst carrying out some research in 1993 Spectre found that the number of customers paying Class 4 National Insurance was significantly higher than the number paying Class 2 National Insurance. That shouldn’t be the case. Almost everyone who registers as self employed has to pay Class 2 National Insurance, but Class 4 only kicks in when a particular profit level is achieved. So there should be more customers paying Class 2 than Class 4. Class 2 is paid by direct debit and Class 4 is collected through self assessment. On carrying out further research Spectre found that the reason why some customs were not paying Class 2 contributions was because for one reason or another they were not registered as being self employed.

Whilst carrying out some research in 1993 Spectre found that the number of customers paying Class 4 National Insurance was significantly higher than the number paying Class 2 National Insurance. That shouldn’t be the case. Almost everyone who registers as self employed has to pay Class 2 National Insurance, but Class 4 only kicks in when a particular profit level is achieved. So there should be more customers paying Class 2 than Class 4. Class 2 is paid by direct debit and Class 4 is collected through self assessment. On carrying out further research Spectre found that the reason why some customs were not paying Class 2 contributions was because for one reason or another they were not registered as being self employed.

A self employed customer is entitled to a state pension based only on his record of paying Class 2 contributions “BINGO” Spectre said out loud. “I’ll let these errant customer off without chasing them for unpaid Class 2 contributions and they’ll only find out that there’s a problem when they retire!”

* * * * * * * * * * * * * * * *

Some years later the government announced that they would from 6th April 2015 collect Class 2 contributions through self assessment rather than by direct debit. Spectre saw that this could be a problem because customers who declare a liability to Class 2 might find that the HMRC computer refunded them because they weren’t registered as being self employed. Those with smart accountants might realise what the problem was and try to limit the damage. Spectre’s mind raced away and he sent an email to the Chancellor suggesting that Class 2 National Insurance should be abolished because it brings in so little money.

* * * * * * * * * * * * * * * *

“I don’t understand” said Clive Jenkins. Clive, a self employed painter and decorator was in the offices of Warr & Co attending a meeting with Edward Peters. Clive was 65. He had moved to the UK from Canada when he was 25 and had set up his own business a year later. Profits has been modest but he had always paid his way and had never let anyone down. He was now looking forward to retirement. The mortgage on his small apartment had finally been paid off a year ago. The £50 per month he had paid into a personal pension for the last 30 years was now worth £50,000 which was going to give him a lump sum on £12,500 and a pension of just under £2,000 per annum. But that would be okay because he was expecting to be able to draw his state pension of around £165 per week in just a few months. Edward Peters had just dropped a bombshell by telling him that his state pension would be nothing like £165 per week.

“You see” said Ed “there’s a 25 year gap in your contributions record”.

“Why haven’t you told me about this before?” Clive asked. “You’ve been my accountant since I started the business”.

”It only just came to our attention when HMRC amended your 2017/18 self assessment and reduced your liability by about £150” Ed said “I made a few phone calls and it seems that the National Insurance Contributions Office decided you were no longer self employed 25 years ago because your direct debit for Class 2 contributions was cancelled. We had no way of knowing that until Class 2 started to be collected through self assessment”.

“I changed my bank account about that time” Clive said.

“Then that’s probably where it all went wrong” Ed responded.

“Surely I can do something Clive said, “Can I make a back payment?”

“Yes, you can” said Ed. “But you can only go back 6 years. You’ll have to pay 6 years Class 2 contributions totalling £936 and 3 years Class 3 contributions totalling £2,340”.

“Surely that’s 9 years” says Clive.

“I’m afraid not, you have to pay 6 years Class 2 contributions at £3 per week simply because you were self employed, but only the last 3 years are made qualifying. The earlier 3 years can only be made qualifying if you pay Class 3 contributions which cost £15 per week”.

“Where will that leave me?” asked Clive

“You will then have 21 qualifying years out of the 35 that are needed for a full state pension, so you’ll get about £99 per week instead of the £165 you were expecting”.

Clive resigned himself to the position he now found himself in “I guess I’ll have to carry on working for another 5 years”.

* * * * * * * * * * * * * * * *

The Chancellor did announce that Class 2 contributions would be abolished initially from 5th April 2018. This was then delayed a year, and this in September 2018 a decision was made not to abolish it in the current parliament.

A person who becomes self employed needs to register as such. It is not sufficient if you are already in self assessment to record income on self employed pages within the return without registering. If you have done this you will pay Class 4 National Insurance, but not Class 2.

If you are self employed, check your pension entitlement here https://www.gov.uk/check-state-pension and make sure that you are on track to build up 35 qualifying years. Do it now, don’t wait until you get to Clive’s age.

And crucially, if you find that HMRC amend your self assessment so that you are not charged for Class 2 contributions, seek advice without delay.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.