Since our earlier pension allowance for high earners blog back in 2019, there have been significant changes that continue to affect high earners and how much tax relief they can claim on their pension contributions.

Investing in your pension pot can still have huge tax relief benefits, even for high earners, but it’s important to understand and adhere to the new annual allowance rules in order to avoid unexpected tax bills. In this updated blog, we’ll outline the new allowance rules and suggest how you can effectively manage your pension contributions.

What is the annual allowance for high earners?

Let’s begin firstly by explaining a little bit about the pension annual allowance: the annual allowance (which remains at £40,000 for most people) is the amount that an individual can contribute to their pension per year and benefit from tax relief. The £40,000 limit applies to the total contributions made, by you or your employer

You can of course go over your annual allowance but you will be taxed on any additional contributions.

Many high earners, however, fall into a ‘tapered’ annual allowance category which significantly affects how much you can contribute to your pension without being taxed. So how do you know if this applies to you?

If you have a threshold income of over £200,000 AND an adjusted income of over £240,000, you’ll fall into the tapered annual allowance category. (Note: if either one of these incomes fall under the limit, you won’t be affected – both incomes need to exceed those limits to be subject to a tapered annual allowance.)

The terminology surrounding threshold and adjusted income can be rather confusing but, broadly speaking, both relate to your total taxable income – the main difference being that threshold income excludes pension contributions whereas adjusted income includes them.

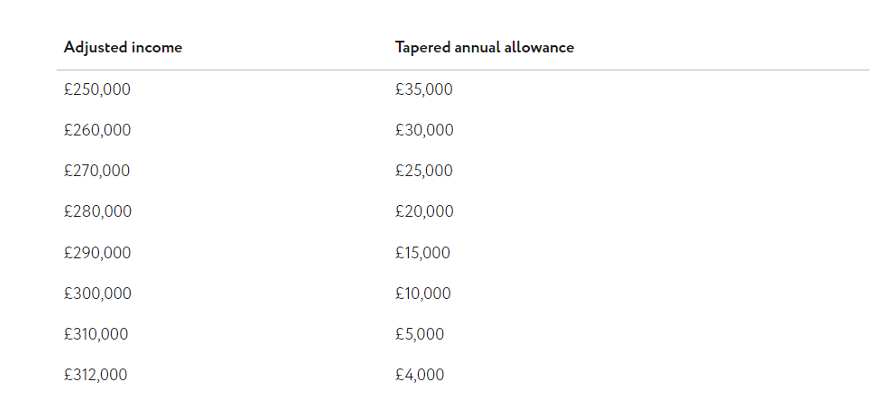

The amount that your allowance is tapered by depends on your earnings. The allowance is reduced by £1 for every £2 over the adjustable income figure of £240,000. There is a maximum reduction set at £36,000 which means that if you have an adjusted income of over £312,000, you’ll qualify for the minimum annual allowance of £4,000. The below table gives a great overview of this:

Source: Nutmeg

Even with a tapered annual allowance, pension contributions can provide high earners with good tax benefits. The percentage of tax relief (or “government top-ups”) you’re entitled to is related to your Income Tax band: higher-rate tax payers can claim a 40% top-up and additional-rate tax payers can claim 45%. This means that even if you’re only entitled to the minimum annual allowance of £4,000, you could still get up to £1,800 tax relief.

What is the carry forward rule?

If you’re nearing your annual allowance limit, it’s worth checking whether you’re eligible to carry forward previous allowances. The carry forward rule is where you can carry through any unused allowance from the last three tax years and add it to this year’s annual allowance – if you meet certain criteria. The two main requirements are:

- You must have had a pension (state pensions don’t qualify unfortunately) for any year that you wish to carry forward – it doesn’t matter whether you made contributions to it or not.

- In the current tax year, you need to be earning no less than the full amount you’re wishing to contribute (including the amount you wish to carry forward). Alternatively, your employer could contribute to your pension.

What is the lifetime allowance?

The lifetime allowance is currently set at £1,073,100. If your pension pot funds go over this amount, you’ll likely face tax charges when you begin withdrawing from it. This could affect high earners who have been contributing to their pension for many years and are now closing in on that figure.

Have you already drawn your pension?

If you’ve flexibly accessed a pension you can only contribute up to £4,000 each year to money purchase pensions

Where can I seek further help?

Knowing how to make the most of your pension pot and the tax benefits you’re entitled to can be very tricky, especially for high earners. But rest assured – here at Warr & Co, we’ll do all of this hard work for you. Our experienced personal accountants will advise you on the best plan of action for you and your specific needs, so you can be confident that you’re contributing to your pension in the most effective and tax-efficient way. Contact us for more information and to book a free initial consultation.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.