The Government held their (Not so mini!) mini-budget on Friday 23rd September announcing £50bn in tax cuts. While the headline sounds great in the face of the cost of living crisis, delve deeper and you may be alarmed by where the cuts have been made!

Essentially the new Chancellor, Kwasi Kwarteng, has un-done a lot of recent tax changes in his mini-budget. Much of this will be welcome news to large and small businesses, but at the heart of small businesses are people – and people are still struggling with the cost of living crisis and soaring inflation.

Designed to ‘jump-start’ our economy, the initial signs aren’t good, with the pound falling to its weakest since 1985. But can huge cuts in tax and huge increases in borrowing really be the solution? It’s extreme, we’ll give them that!

IR35 Reform Scrapped

Let’s start with IR35 reform. IR35 reform came in in 2017 (public sector) and 2021 (private sector), and it dictated that a contractor could no longer be trusted to determine their own employment status for tax purposes – the engager was to do so instead. This caused chaos across the private and public sectors, with companies suddenly responsible for financial determinations for another business having very little education around IR35, understandably.

The reform section of IR35 is to be scrapped completely as of April 2023 – so if you could all just get in your time machines and teleport back to 2016 please, that’s basically the gist of it (wouldn’t that be great!).

We have more thoughts on IR35 reform being scrapped, you can read them in this blog, but for now we’ll just say this is probably the most positive thing to come out of the mini-budget. Better for PSCs and better for companies who hire PSCs, but is the damage already done? We will wait and see…

Corporation Tax Will Remain at 19%

The complex Corporation Tax rise from 19% up to 25%, which was to be tapered towards the larger companies paying a proportionally higher rate and the smaller companies remaining at 19%, will be scrapped completely too. The increase was only announced in Spring 2022 and was potentially a challenging road ahead for larger companies, so this is good news for businesses who would have been looking at higher tax rates in the coming years.

At 19% it’s the lowest tax rate in the G20 – will it bring investment into the UK? That is the hope!

Higher Rate Income Tax Scrapped & Basic Rate Cut to 19p

(Update 02/10/2022 – The Government has u-turned on the abolition of the 45% additional rate of tax – it will remain in-place after exceptional back-lash from the media, the public, and in particular the higher earners)

The 45% additional rate of tax is due to be abolished completely. The highest rate tax band is only applicable to those earning over £150,000 a year… Are these the individuals in desperate need of a tax cut, we wonder? The 40% higher rate will now be the maximum rate income can be taxed at.

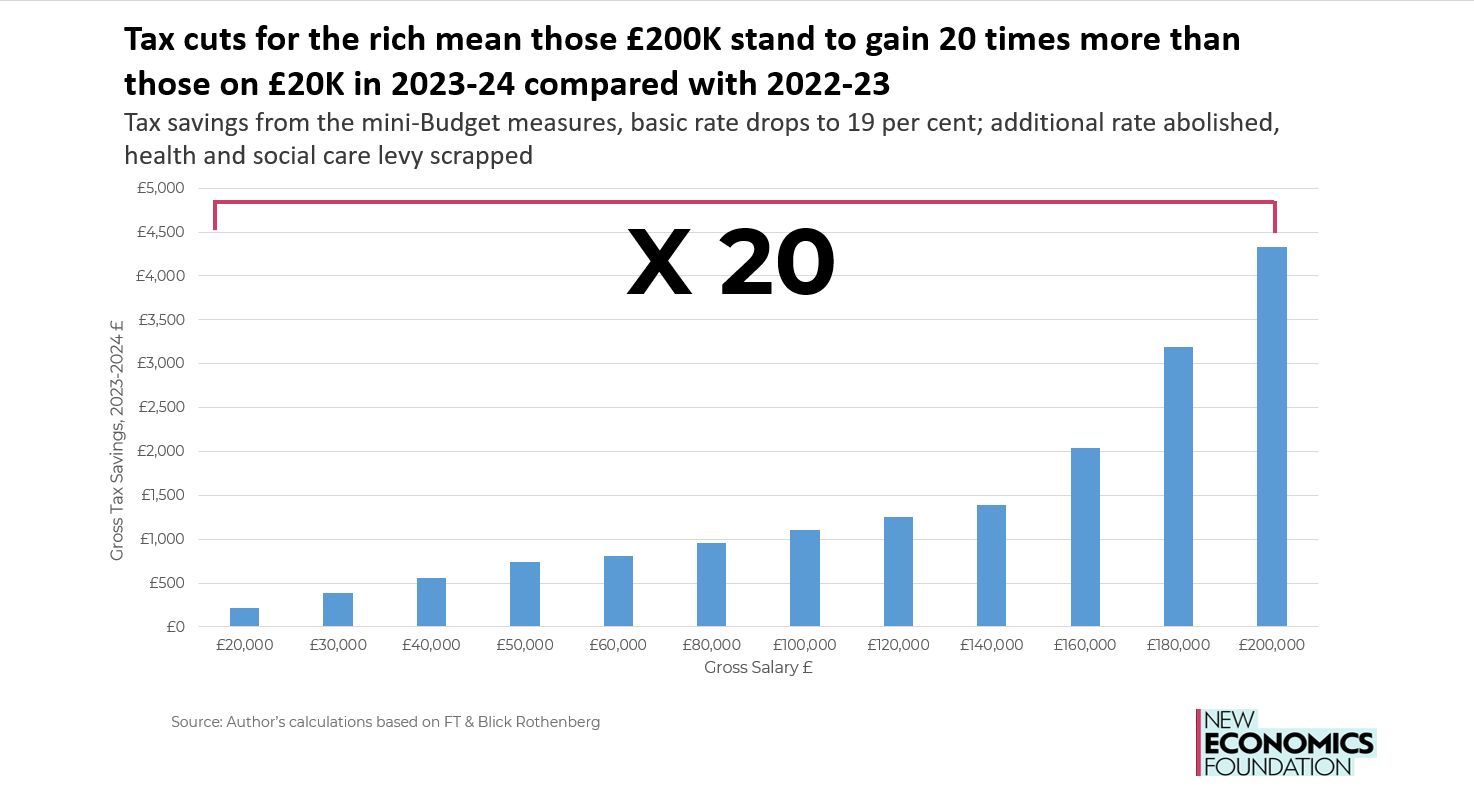

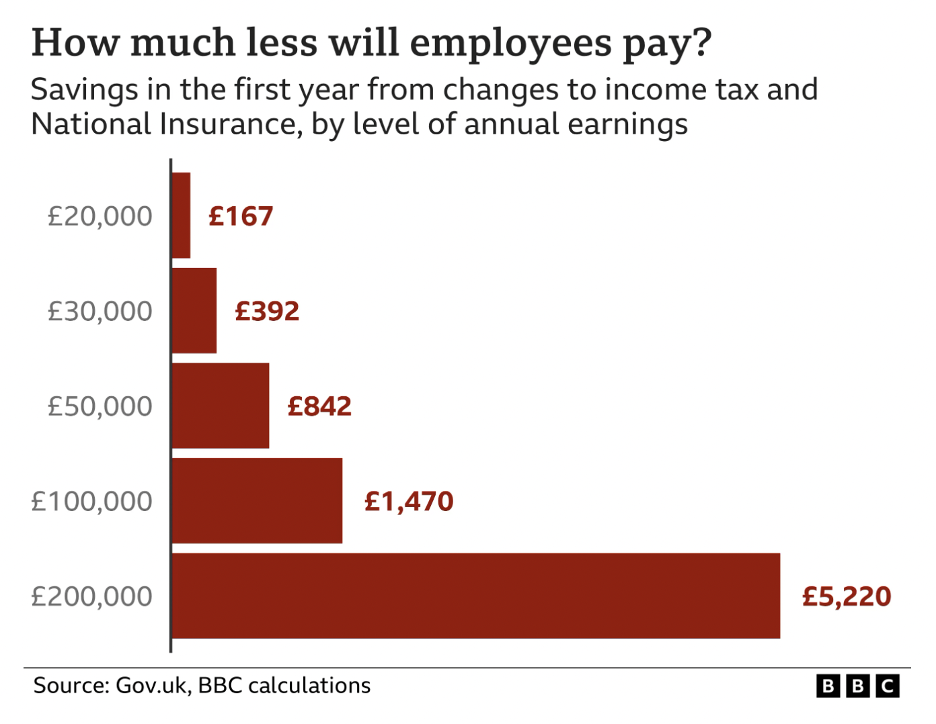

And in other news, the basic rate of income tax will be cut to 19p in April 2023, the cut was planned to come in 2024 and has now been brought forward – the headline sounds great ‘31 million people will save money’, yes but at an average of £170 per year. Let’s look at these numbers more closely…

As an example, those earning £20,000 per year will be £167 per year better off after this budget, compared to those who earn £200,000 a year who will be saving £5,220 per year. If we consider which of these two hypothetical individuals will need help paying to keep the heating on this winter, it is a sad day indeed. (*figures inclusive of NI changes below)

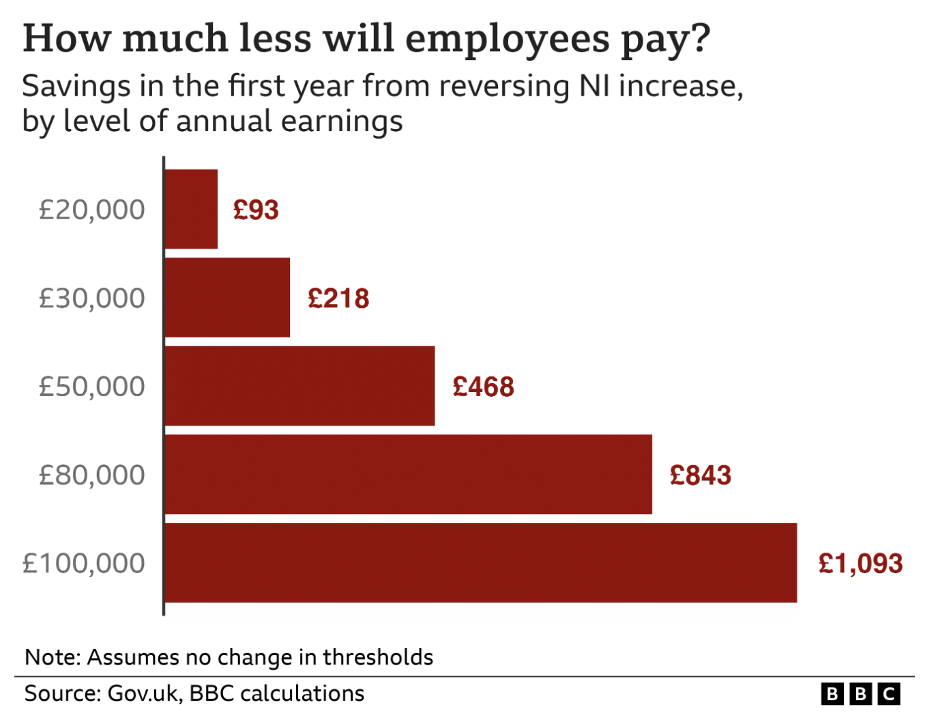

Recent National Insurance Updates to be Scrapped Too

The 1.25% national insurance rise is to be reversed from November 2022, this means the average worker will save £330 per year. In addition, 920,000 businesses will save around £10,000 next year thanks to the reversal.

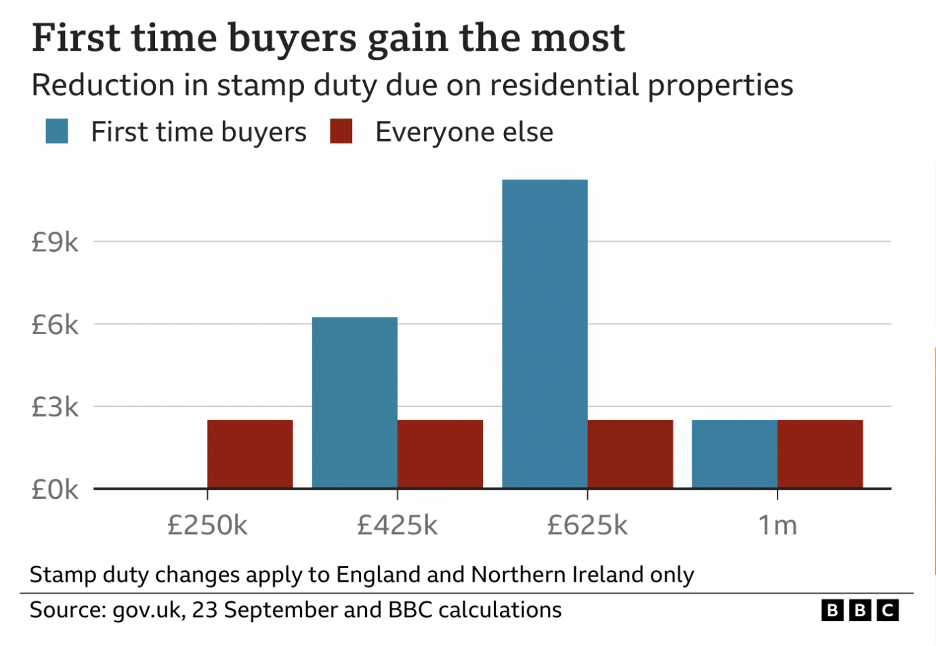

Stamp Duty

From 23rd September Stamp Duty will only be due on residential property purchases over £250,000, this is double the current limit. This is a positive move, since properties under £125,000 are virtually non-existent now.

And the threshold for relief on first time home purchases will increase from £300,000 to £425,000, with the maximum property value the relief is applicable to also being increased to £625,000.

Is a VAT cut in the Works Too?

There is also talk of Truss cutting VAT from 20% to 15%, something she was considering ahead of her appointment as Prime Minister, this would make a good dent into the cost of living crisis for most people. But, is this type of extreme financial shockwave possible in the light of these tax cute and the increase in borrowing? We shall see!

You can find further details of the mini (huge) budget here on this link, and if you have any questions for your accountant regarding the announcements, please do get in touch with us.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.