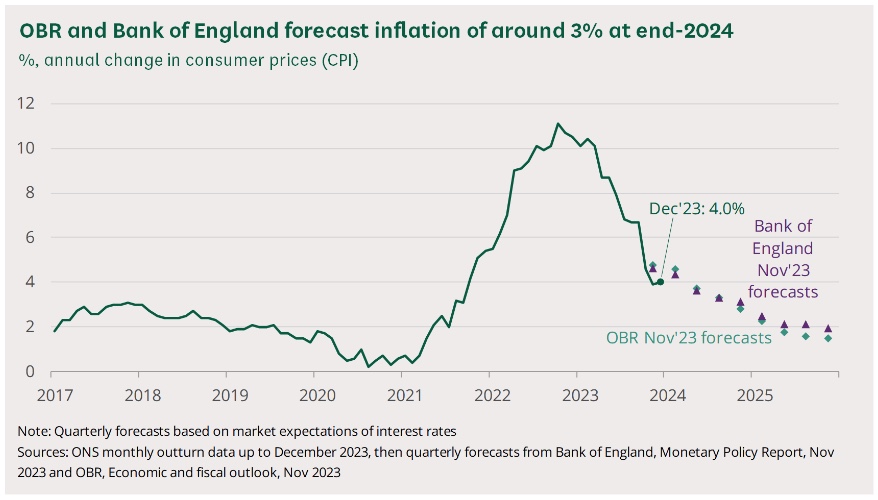

The annual rate of inflation peaked at a 41-year high of 11.1% back in October 2022 in the aftermath of the pandemic and soaring energy prices. Since then the rate has – on the whole – been falling but remains considerably high. This high inflation rate goes hand in hand with our cost of living and impacts households and businesses alike.

Accompanying the Autumn Statement, the Office for Budget Responsibility (OBR) published its prediction that the annual inflation rate would continue to fall, albeit more gradually, throughout 2024, reaching an average of 2.8% in Q4. Although this is likely to be welcome news for many, it’s still higher than the Bank of England’s target of 2% – now not expected to be reached until sometime in 2025.

The below graph gives a great visual overview of the inflation rate over the last few years, outlining both the OBR’s and Bank of England’s 2024 Q4 predictions:

Image source: House of Commons Library

What could falling inflation mean for individuals and small businesses?

It’s important to note that falling inflation doesn’t mean prices are falling; prices are still rising – just at a slower rate. So whilst the inflation rate decreasing is promising and is likely to mean that cost of living is easing slightly, it doesn’t mean that we’ll necessarily be financially better off. Given that the inflation rate is set to remain higher for longer than originally anticipated, it’s likely that this will keep interest rates elevated for longer too.

Unfortunately, there’s no one-size-fits-all approach when it comes to determining how individuals and businesses may be affected by falling inflation; we’re all impacted in different ways depending on our individual circumstances. For individuals, this may be determined by our spending habits, housing costs and other expenses (the Office for National Statistics has a handy calculator you can use to help you work out your personal inflation rate). For businesses, it will vary depending on your specific industry and the types of goods or services that you sell or buy, amongst many other factors.

Our top tip: seek an accountant’s advice!

If you’re feeling perplexed about falling inflation and what this could mean for you, you’re not alone. It can be extremely confusing and complicated to get your head around, given that it can vary so much from person to person. Therefore, our top tip would be to seek an accountant’s advice. An experienced and knowledgeable accountant will take the time to thoroughly understand your individual circumstances so that they’re in the best position to offer financial advice that’s tailored specifically to you.

Here at Warr & Co we work with thousands of individuals and businesses from all walks of life, helping them maximise their finances, minimise their tax exposure and plan for a financially successful future. Find out more about our services by requesting a consultation with one of our company directors. It’s free and comes with no obligation at all – just friendly, professional and personalised advice!

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.