STUDENT LOANS AND BASIS PERIOD REFORM

New guidance from HMRC confirms that profits used to assess student loan repayments and entitlement to student finance will include transitional profits from basis period reform. Student loan repayments for self-employed taxpayers are based on the profits reported in each tax year. For the tax years 2023-24 to 2027-28 this will be your normal profit plus the portion of the transitional profits you decide to bring into that year. The additional profit could cause a dramatic increase in your student loan repayments in one or all of the five years.

Transitional profits are spread evenly over the five years by default, but you can choose to bring more than the minimum additional profit into any of the years. It might be possible to manipulate the spreading of your transitional profits so that your income remains under the threshold for one or more of those years.

If you are self-employed and you are applying for student finance such as a maintenance loan for your child, your income will be taken into account. Normally the assessment is based on the tax year two years before the application but you can opt to use the current year figure if you can show that your income has fallen by at least 15%.

If because of basis period reform the income that you report in 2023-24 is 15% or more lower than in 2021-22, it would be better to use the current year amount for the student finance application.

There are many factors to consider when determining the most efficient way to spread the transitional profits over the five-year period. We can help you calculate the most beneficial allocation for you.

CRYPTO INVESTORS URGED TO DECLARE GAINS

HMRC has reminded investors in cryptoassets that they should declare any income or gains above the tax-free allowance on a tax return. If you hold cryptoassets such as Bitcoin you need to pay tax on any income or gains you have made. Most individuals investing in cryptoassets will be subject to capital gains tax on the following activities:

- selling cryptoassets in exchange for regular currency;

- exchanging cryptoassets for other cryptoassets;

- gifting cryptoassets to anyone other than a spouse or civil partner; and

- using cryptoassets to buy goods or services.

In some exceptional circumstances, an individual transacting in cryptoassets may be deemed to be trading and subject to income tax rather than capital gains tax.

If you need to report income or gains on cryptoassets that relate to the tax year 2023-24 these can be added to your self assessment tax return.For gains relating to 2022-23 there is still time to amend a previously submitted return.

For any gains relating to previous tax years HMRC has launched a voluntary disclosure service to enable taxpayers to report undeclared income or gains.

Using the new service is not compulsory and taxpayers with more complex tax affairs, or undeclared gains not related to cryptoassets, should consider other reporting routes. We can help you decide on the most suitable option for you.

MANDATORY PAYROLLING OF BENEFITS

The reporting and paying of income tax and Class 1A national insurance contributions on benefits in kind is to be made mandatory via payroll software from April 2026. Most employers who have not entered into a PAYE settlement agreement currently report benefits in kind (BIKs) provided to employees on the P11D form and calculate Class 1A national insurance contributions (NIC) at the end of each tax year.

To simplify and digitise the process, from April 2026 the Government will mandate the reporting and paying of income tax and Class 1A NIC on BIKs via payroll software. The taxable BIKs will be calculated for the year and the monthly amount (ie one twelfth of the annual amount) will be added to the employee’s monthly payslips, with tax deducted accordingly.

This will lessen the administrative burden for employers; remove the need for end of year returns to be submitted; and simplify the tax affairs of individuals, reducing the need for them to contact HMRC.

HMRC will engage with stakeholders to discuss their proposals to inform design and delivery decisions, and draft legislation will be published later in the year. Guidance will be made available in advance of 2026.

The payrolling of benefits and the associated advantages to employers don’t have to wait until 2026. If. you’d like to discuss introducing this system sooner, contact us.

MAKING TAX DIGITAL: QUARTERLY UPDATE RETURNS

HMRC has confirmed the mandation dates for making tax digital for income tax self assessment (MTD SA) as announced in the Autumn Statement 2023.

From April 2026, taxpayers subject to income tax on their trade, profession, property income or business and who have income above £50,000 will be required to keep their accounting records electronically (either using suitable software or on a spreadsheet) and file quarterly update returns to HMRC with details of their income and expenditure together with any other information that HMRC specifies.

The mandation date for self-employed taxpayers and landlords with income between £30,000 and £50,000 is April 2027. There are currently no plans for MTD SA to be implemented for taxpayers with income below £30,000.

HMRC has also published an update notice announcing that quarterly updates will be cumulative. This will allow errors in one quarter’s reporting to be updated in the following quarter, removing the need to resubmit previous quarters.

The requirement to submit an end of period statement in addition to quarterly returns has been removed as planned.

Taxpayers who file self assessment tax returns with income above £50,000 need to prepare for MTD SA now. We have been preparing for MTD and can advise you on the best options for your business.

SUBPOSTMASTERS’ COMPENSATION

There are currently three forms of compensation being awarded to subpostmasters following the Horizon scandal and each will have different tax implications.

Money paid to subpostmasters under the Group Litigation Order (GLO) and overturned convictions schemes is not taxable.

These payments are awarded in recognition of the unfair and unequal treatment the subpostmasters received, rather than to recompense a financial loss. They are therefore not taxable because they do not link to a taxable event. The Historic (or Horizon) Shortfall Scheme (HSS) compensation scheme is made up of three elements.

- Returning subpostmasters’ own money to them to the extent that they can prove they used it to meet alleged shortfalls in their takings: this is not taxable but it is repaid with interest on which tax is payable.

- Damages for personal loss: this is not taxable as there is no taxable event and there is no interest added.

- Compensation for loss of office, on which interest is applied: this is taxable because had the subpostmasters been paid correctly in the relevant years they would have been taxed on that income.

The compensation for loss of office should have been paid to the subpostmasters net of basic rate tax which the Post Office should have deducted at source. As payments were made gross and in one lump sum, several subpostmasters will be pushed into higher tax brackets up to 45% (or now up to 48% for Scottish taxpayers). In recognition of this the Government offered top up payments to affected subpostmasters to help them pay the excess tax due. The top up payment is not taxable.

If you have received or been offered compensation payments as a result of the Horizon scandal, it is important to understand the tax implications and the amounts that may need to be included on your self assessment tax return. We can help you with this.

ADVISORY FUEL RATES

HMRC has updated the recommended reimbursement rates for employees reclaiming business travel in company vehicles.

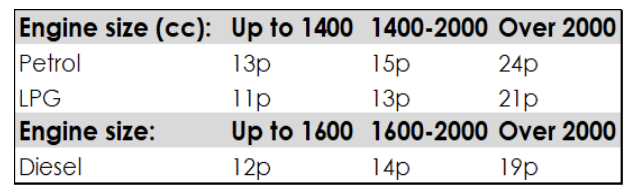

If you pay for the fuel in your company car your employer can reimburse you for the cost of business journeys in that car at the following mileage rates tax free from 1 March 2024:

The advisory reimbursement rate for fully electric cars will be 9p per mile. Hybrid cars are treated as petrol or diesel cars for advisory fuel rates.

The above rates only apply to employees using a company car.

If you use your own car or van for work, the maximum amount you can be reimbursed tax-free is 45p per mile for the first 10,000 miles and 25p per mile thereafter. This amount was last updated in 2011.

An additional 5p per mile can be paid per passenger, provided that the journey is also business travel for the passenger.

The rate for employees using motorcycles is 24p per mile. Where an employer uses their bicycle for work, the approved rate is 20p per mile. These amounts have not been updated since at least 2001.

If an employer chooses to make payments in excess of the mileage rates above to better reflect the costs of running a vehicle there will be tax complications for the employer and the employee.

VAT ON ENERGY SAVING MATERIALS

The zero rate of VAT has been extended to include the installation of additional energy-saving materials (ESMs) from 1 February 2024. The installation of certain specified energy-saving materials (ESMs) in residential accommodation is zero rated for VAT. The more common ESMs include:

- controls for central heating;

- draught stripping;

- insulation;

- solar panels;

- ground-and air-source heat pumps;

- micro combined heat/power units and wood-fuelled boilers; and

- wind and water turbines.

From 1 February 2024 that list has been extended to include:

- batteries;

- water-source heat pumps;

- diverters retrofitted to existing ESMs such as solar panel or wind turbine systems; and

- heat pump groundworks that are integral to the installation of a ground-source heat pump.

The zero rate applies to the installation of ESMs, so where materials are only purchased – not installed – they will be standard-rated.

A charity qualifies for the zero rating where the property in which the installations take place is used for charitable non-business activity. What is or is not charitable non-business activity can be difficult to determine but village halls or similar are often capable of attracting the relief.

The installation of ESMs may require ancillary works or supplies and these can also be zero-rated.

If you have recently installed new ESMs, speak to us about your VAT position.

CAPITAL ALLOWANCES FOR PARTNERSHIPS

HMRC has clarified the rules relating to capital allowances claims in mixed partnerships, confirming that all partners subject to corporation tax are eligible for enhanced capital allowances.

Corporate taxpayers are entitled to certain accelerated capital allowances such as full-expensing and the super-deduction that are not available to individuals subject to income tax. In a partnership where all the members are subject to income tax, the process is simple: capital allowances are deducted from income and profit is distributed to members in accordance with the profit-sharing agreement.

In a corporate partnership, ie one where all of the members are subject to corporation tax, the capital allowances that are deducted from income include full-expensing and other investment incentives that are only available to companies.

Where a partnership has some corporate members and some members who pay income tax, the deduction of capital allowances is more complicated as profit is calculated for the partnership, but only the corporate members are entitled to enhanced capital allowances.

HMRC has updated its partnership manual to confirm that the corporate members of such partnerships should receive the same level of capital allowances as they would outside of the partnership. Guidance on how to achieve this has been added to the manual. It advises that such partnerships may need to submit more than one computation; one in respect of members who are subject to income tax and one for corporate members.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.