Last week, the new-new Chancellor, Jeremy Hunt, delivered the new-new Autumn Budget in Parliament. There’s some good news; inflation is predicted to begin to fall half way through 2023. And…

Last week, the new-new Chancellor, Jeremy Hunt, delivered the new-new Autumn Budget in Parliament. There’s some good news; inflation is predicted to begin to fall half way through 2023. And…

Here’s a round-up of everything you may need to know Tax-Wise for this winter period and looking further into 2023. To say there’s been turbulence would be an understatement, but…

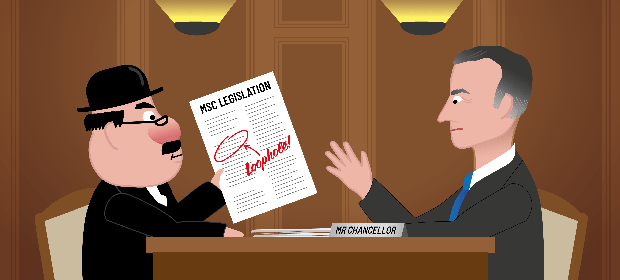

Ian Spectre has just arrived at No.11 for his weekly briefing meeting with the Chancellor. The only item on his agenda is the loss of revenue that will result from…

The end of the year is often the time for reflection, to evaluate your goals and make resolutions for the new year. If you’re considering setting up a new business…

If you’re a contractor or a business who hires contractors, you’ll most likely be getting quite frustrated at the constant back-and-forth that we’ve had in relation to IR35 in the…

It’s a crisp October morning and Ian Spectre is in Westminster on his way to a meeting with the new Chancellor to give his views on the mini budget. “Edward…

In September’s ‘mini-budget’ the new Chancellor Kwasi Kwarteng announced that IR35 Reform is to be repealed as of April 2023. This is big news for PSCs and the engaging companies…

We’ve put together our Autumn Tax roundup to provide a quick overview of current tax updates for small businesses and individuals. If you’d like more information about any of these…

Rising energy prices continue to push UK inflation up, which hit 10.1% in July – a figure that’s five times higher than the target set by the Bank of England….

HMRC has recently named and shamed two tax avoidance schemes: Peak PAYE Ltd and Best Employment Services, which have both been exposed as exploiting the tax system, leaving customers footing…