We’ve put together our Autumn Tax roundup to provide a quick overview of current tax updates for small businesses and individuals. If you’d like more information about any of these…

We’ve put together our Autumn Tax roundup to provide a quick overview of current tax updates for small businesses and individuals. If you’d like more information about any of these…

Broadly speaking, Business Interruption Insurance covers businesses for losses incurred due to various unexpected events, such as fires, floods etc. Over the last few years the pandemic has undoubtedly caused…

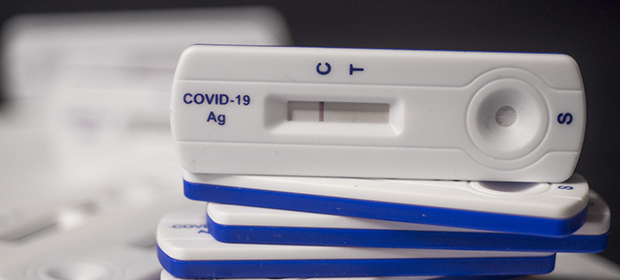

As of 1st April, universal free coronavirus testing is no longer available – it’s now only offered to those who meet certain criteria (find out more here). So what does…

A new helpline has been set up by HMRC for those businesses, including self employed people, who are concerned about their ability to pay tax due to the pandemic.

There’s no arguing that the pandemic has drastically affected the property market, with the ‘race for space’, the recently concluded Stamp Duty Holiday and the struggle between property supply and…

On the 27th October Chancellor Rishi Sunak delivered the Autumn Budget for 2021, announcing the updates we can expect in the near and mid-term future. While there don’t appear to…

As we try to settle into our new normal, one thing is sadly inevitable; Covid-19 is here to stay. There will be many challenges as we settle into our updated…

Are we on the verge of returning to ‘normal’? Maybe. The vaccine programme is proving promising, but what if – like many – you’ve been told you now predominantly WFH?

The Self Employed Income Support Scheme (SEISS) launched last year to help self employed individuals who were unable to work has been popular but flawed. And now penalties will be…

In the Spring Budget a new wave of business support measures were announced to aid businesses currently closed due to the pandemic, with hopes that we will be able to…