Introduced back in April 2021, the off-payroll working rules (IR35) have been a source of confusion and consternation for businesses wishing to engage the services of a contractor. The intention…

Introduced back in April 2021, the off-payroll working rules (IR35) have been a source of confusion and consternation for businesses wishing to engage the services of a contractor. The intention…

HMRC’s Check Employment Status for Tax (CEST) tool – used by companies, agencies and contractors to determine IR35 status – has been heavily criticised ever since its creation in 2017….

As a busy freelance contractor working in the North West we know your time is incredibly valuable and the last thing you need is the stress and worry over getting…

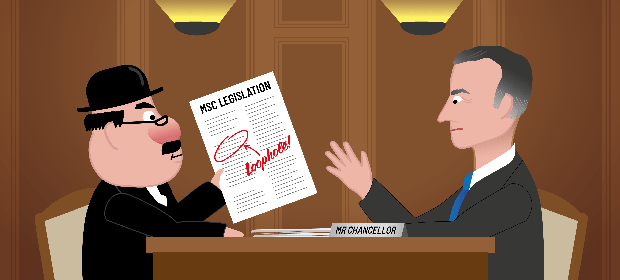

Ian Spectre has just arrived at No.11 for his weekly briefing meeting with the Chancellor. The only item on his agenda is the loss of revenue that will result from…

If you’re a contractor or a business who hires contractors, you’ll most likely be getting quite frustrated at the constant back-and-forth that we’ve had in relation to IR35 in the…

It’s a crisp October morning and Ian Spectre is in Westminster on his way to a meeting with the new Chancellor to give his views on the mini budget. “Edward…

In September’s ‘mini-budget’ the new Chancellor Kwasi Kwarteng announced that IR35 Reform is to be repealed as of April 2023. This is big news for PSCs and the engaging companies…

On the 5th September the new PM will be announced, and at a time when there is so much financial turmoil in the country it’s no surprise the final two…

A recent report published by the Public Accounts Committee (PAC) suggests the IR35 reform has been quite the disaster – no surprise there – but one of its most shocking…

New research from IPSE suggests that the UK may be about to lose 50% of its freelance contractor workforce due to the new IR35 legislation.