Ian Spectre has just arrived at No.11 for his weekly briefing meeting with the Chancellor. The only item on his agenda is the loss of revenue that will result from the ill thought out changes to IR35 and how to recover it.

“Who are you” Spectre asked as he walked into the Chancellor’s office.

“I’m the new Number 2” came the reply.

“Who is number 1?” Spectre asked.

“I am number 2, now take a seat number 6 and let’s get started. You’ll be pleased to learn that I’m revoking almost all of the mini budget that the old number 2 announced”

“Including the changes to IR35” Spectre asked.

“Yes, including those” the Chancellor replied. But I want to go further and hit those who’ve managed to work outside IR35. Do you have any ideas number 6?”

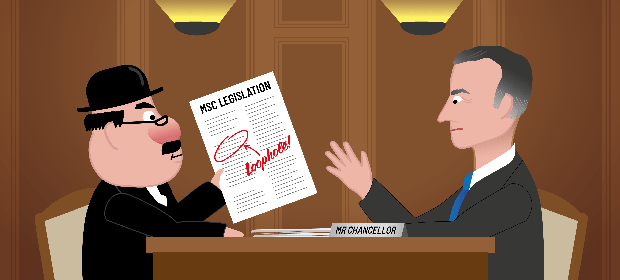

“Well, I’ve been doing some lateral thinking and re-visited the Managed Service Company Legislation” Spectre said.

“Yes. I remember that.” Number two replied “This was brought in because accountants actually started running companies for contractors. The contractor was a shareholder and employee, but not a director. That legislation brought an end to these so called composite companies and so we haven’t needed to use it. But accountants are compliant now aren’t they? Surely we can’t use this legislation”.

“When I drafted this legislation I did so to ensure it could potentially be used against agents placing contractors with clients and also accountants representing contractors.”

“That sounds a bit draconian Number 6” the Chancellor replied.

“Yes, Chancellor but we haven’t used it yet and will only do so in abusive cases. We’re unlikely to be calling at Warr & Co but there are a lot of contractor service organisations in cahoots with agencies out there, we’ll be after them.”

With that the meeting ended and Spectre returned to his offices wondering why the new Chancellor referred to him as Number six. “I am not a number” he thought to himself “I am a free man”. Spectre heard laughter from within No. 11.

On a cold Tuesday evening back in January 2019, Andy Burns is having a drink with Paul Littlewood in a plush London bar. Andy has spent ten years building up Rook Attlee, a specialist contractor accountant. Rook Attlee have 1,000 contractors on their books. Paul runs the London office on Contractor Care, an agency specialising in the placement of contractors with clients. Andy started the conversation.

“Thanks for the five referrals over the last month, I’ve brought you an i-pad. Why don’t you give it to that nice new receptionist you’ve taken on? Let her know it’s from me and she’ll sing our praises when she’s talking to contractors. Now tell me about this woman who’s coming to see me tomorrow.

“Oh yeah, Linda Jenkins” Paul replied, “I’ve written all of her details down on this piece of paper for you. She was all set to go to Warr & Co but I told her that she should go to you because you’ve invested in the right systems and are more of a specialist. She also asked about umbrella companies and I told her that she’d pay less tax if she used a limited company.”

“Spot on” said Andy, “I’m, going to have to go now. Thanks for these details on Linda”.

“Ok, let’s meet up next month. Oh, and I haven’t told Linda that I passed you those details.”

It’s now a Wednesday morning in January 2019. Linda Jenkins had just arrived at the offices of Rook Attlee for a meeting with Andy Burns. After exchanging pleasantries, Andy started the meeting proper. “I’ve completed most of the paperwork, your company is called Linda Jenkins Associates Limited and I’ve got your bank account application here you just need to sign it where I’ve indicated. This booklet tells you how the system works. Basically you upload scanned images of expense receipts, Paul Littlewood will let us have your invoices, and your bank transactions will download into our system. Of course you retain complete control of your bank account but we’ll tell you what to pay and when”.

“How will I get paid?” Linda asked.

“Good question Linda.” Andy replied. “You’ll get your expenses repaid of course, but the profits will be paid to you as salary and dividends, our system will work it all out”.

“How do I know what expenses to claim?” Linda asked.

“It’s all in the booklet”

“I thought I might retain money I don’t need in the company and in a few years, have the company invest in a buy-to-let” Linda said.

“No, you really don’t want to do that” Andy said “keep it simple and it won’t go wrong. If you want a buy-to-let, do it in our own name”

“And what’s this going to cost me?” Linda asked.

“It’s simple again Linda. We take a direct debit of £99 plus VAT a month”.

“What is there’s a tax enquiry” Linda asked

“No problem Linda, the fee you pay includes tax investigation cover so that professional fees are paid. The most likely enquiry is around IR35, so let me tell you about our Gold Package. For an extra fifty quid a month, all tax liabilities relating to an IR35 enquiry by HMRC will be paid so you will have nothing to worry about. The premium is small because HMRC have very little chance of showing you will be caught by IR35. Paul put together a very good outside of IR35 contract for you”

“You seem to have covered everything” Linda said. “Just one question though, are you a Chartered Accountant?”

“No Linda, I’m a businessman. Accountants are dinosaurs, we use computer systems”.

Linda signed up and left the office feeling re-assured. She had nearly four very good years and used most of the surplus cash she received from her company to put down a large deposit on her first apartment.

It’s now 7 November 2022. Linda is alone and sobbing in her apartment. The letter she has received from HMRC dated 31 October 2022 demands that she pays £70,000 within 30 days. It explains that Linda Jenkins Associates Limited is a Managed Service company and that Contractor Care and Rook Attee are Managed Service Company Providers. It directs Linda to the Managed Service Company Legislation https://www.legislation.gov.uk/ukpga/2003/1/part/2/chapter/9.

In a phone call she had with Andy Burns’ successor it was explained that insurance she had only covered IR35 tax liabilities and this was different.

The characters and organisations in this blog are fictional, but the Managed Service Company Legislation is real. A number of contractor clients of at least one accountant have received assessments from HMRC. The accountants in question are appealing on behalf of their clients and maintain that they themselves are not Managed Service Company Providers.

Some of the bad practices included in our blog that point towards the legislation applying are:

- the gift of an i-pad by Andy Burns for client referrals;

- the level of influence Paul Littlewood exercised in persuading Linda Jenkins to use Andy Burns;

- the use of a standard outside of IR35 contract by Paul Littlewood;

- the disclosure of confidential information by Paul Littlewood to Andy Burns without Linda Jenkins’ consent;

- the level of influence Andy Burns exercised over Linda Jenkins in terms of company formation, its bank account, the accounting systems Linda would use and the method by which she would be paid; and

- the inclusion of an insurance policy designed to pay tax liabilities.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.