Support for self employed individuals is available, but not everyone is covered unfortunately. If you use an accountant, your accountant cannot apply for this support on your behalf. So we’ve written this step-by-step guide to help you through the process.

Support in the form of a one-off payment covering the March, April and May 2020 period will be available to those eligible at the start of June, and we are now at the stage where self employed people should check their eligibility and prepare themselves and their businesses in line with the support available to them. Let’s take a look back at the basics to begin with:

Who Can Apply

You can apply if you’re a self-employed individual or a member of a partnership and:

- Have trading profits of up to £50,000 per year (averaged out over three years)

- The majority of income must comes from self employed work

- Have submitted a Tax Return for the 2018-19 year

- Must be trading at the moment (or would be if not for COVID-19 restrictions)

And the support they will receive:

- 80% of your trading profits per month (averaged out over the last 3 years of profits)

- Up to a maximum of £2500 per month

- Three month’s worth of support which will be extended if necessary

- A lump sum payment of the three months worth of support expected to be put into each person’s bank account at the beginning of June

- Unlike a furloughed employee, you may continue to operate the business

- Remember this support is taxable

And now onto the actual process…

How To Apply

Firstly, it’s worth checking your eligibility for this support scheme. There is an online tool provided by the Government found on the link below.

https://www.tax.service.gov.uk/self-employment-support/enter-unique-taxpayer-reference

You’ll need the following information available:

- Your Unique Taxpayer Reference (UTR) number

- Your National Insurance (NI) number

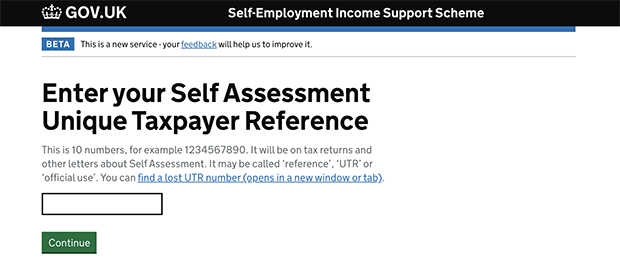

Step 1)

Enter your UTR number – if you’ve misplaced this you can find advice about where you can locate your UTR on this link: https://www.gov.uk/find-lost-utr-number

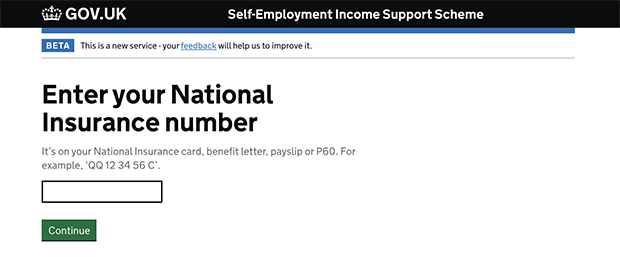

Step 2)

Enter your NI number – if you’ve misplaced this you can find advice on how you can access your NI number on this link: https://www.gov.uk/lost-national-insurance-number

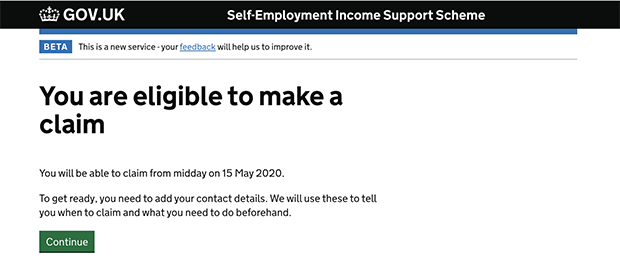

Step 3)

You’ll be told straight away if you’re eligible or not. This screen will also tell you when you’ll be able to make your claim, in this example that is 15th May 2020.

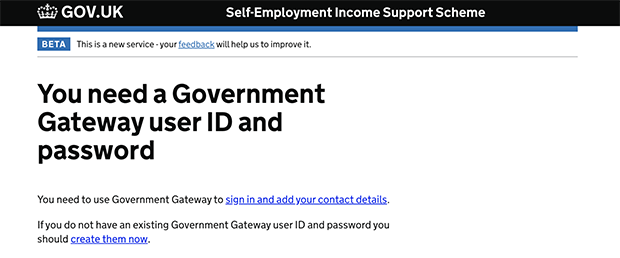

Step 4)

Once you’ve checked that you are eligible, you’ll need to click ‘Continue’ to move to the next step. The next step requires you to use your Government Gateway ID. Many self employed individuals will not already have a Government Gateway ID. If you do have one, please sign in, if you don’t then please follow the advice in Step 5.

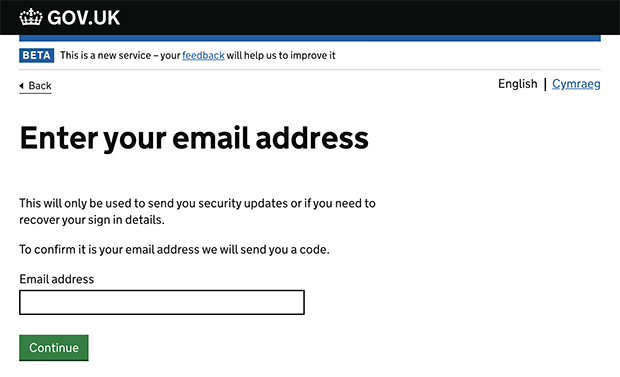

Step 5)

You’ll need to provide an email address, this does not have to be a business email address, but it should only be accessible by you.

- You’ll receive an email notification containing a code to confirm your email address

- You’ll then be asked for your name and a password you’d like to use

- Then you will receive your Government Gateway User ID – this will be a 12 digit number – keep this safe because you will need this to login to your Government Gateway account

Step 6)

Now that you have your Government Gateway ID you may login and click to claim on this support scheme. You’ll be asked to provide the bank account details to which you’d like your grant to be paid into. The amount you’re eligible for will be automatically calculated based on your self assessment tax returns.

Step 7)

Click to claim, you’ll be told right away if your claim has been approved, and if so it will be paid into the specified bank account within 6 working days. Remember you must keep a record of this grant, as it is taxable and will need to be recorded on your Self Assessment Tax Return and on any tax credit claims (including Universal Credit). Please record the following:

- the amount claimed

- the claim reference number for your records

- evidence that your business has been adversely affected by coronavirus

Please consult the Government’s ‘Check if you can claim a grant through the Self-Employment Income Support Scheme’ page if you need further guidance.

How Warr & Co Can Help

Unfortunately, your accountants are not allowed to make this claim for you. So the best we can do at this time is provide this guide to you. Please follow the steps and if you are found to be ineligible please do contact us, there may be other support routes open to you, but we are aware there will be some self employed individuals who will not be covered by this self employed grant.

Finally, please be aware of scam callers and emails regarding this scheme. You will never be asked to input any information on a non gov.uk website. Scammers may also claim they can complete this information for you – this is not true, please do not release any personal details to individuals or businesses claiming that they can complete this process for you. If in doubt, ignore calls or emails that seem suspicious and follow the steps above.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.