With certain coronavirus measures remaining in place for the foreseeable future, the chancellor has announced that there will be a temporary holiday on stamp duty for buyers.

Applicable to the first £500,000 of all property sales in England and Northern Ireland, a raised tax threshold will be in place until next March to bolster the property market and assist struggling buyers. A welcome relief for those looking to get on the property ladder, this stamp duty holiday hopes to lighten the load for buyers.

What is stamp duty?

If you’re buying a home in England or Northern Ireland, you will need to be aware of the Stamp Duty Land Tax (SDLT).

Stamp duty is essentially a tax that is applied to a residential property or piece of land in England and Northern Ireland. Whilst a tax like stamp duty exists throughout the UK, in Scotland this is the Land and Buildings Transactions Tax and in Wales, the Land Transaction Tax. Depending on the price of the property in question and your location within the UK, the amount due to the government will alter.

However, the recent changes to stamp duty will only apply to buyers in England and Northern Ireland.

Landlords and those purchasing additional dwellings will still receive a tax cut, but will need to pay the extra three percent Stamp Duty surcharge which applies to second homes on a property costing more than £40,000.

How has Stamp Duty changed?

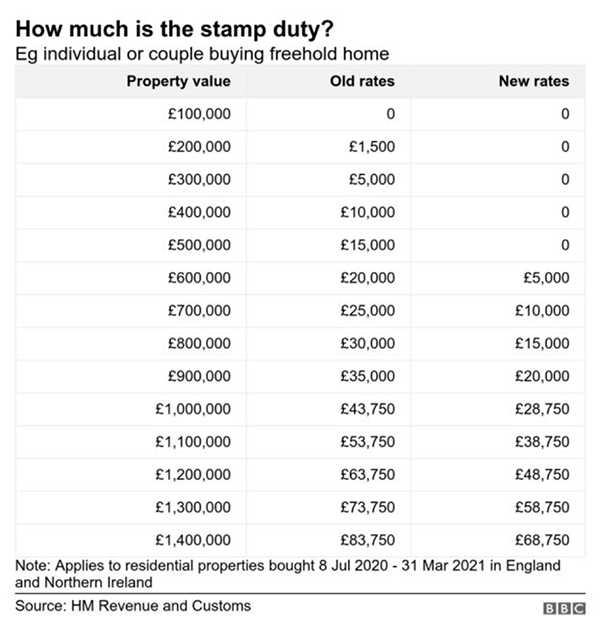

The government has temporarily increased the threshold for stamp duty to £500,000 regarding property sales in England and Northern Ireland until 31 March 2021.

In terms of what this means for individuals, those completing payments on a man residence costing up to £500,000 between 8th July and 31st March will not need to pay any stamp duty. More expensive properties will only be taxed on the value above this threshold.

With this scheme set to save buyers up to £15,000 if they are buying a property of £500,000 or more, it’s set to considerably ease pressure on buyers. As the coronavirus crisis may have hit some hard, this stamp duty holiday aims to remove some of the financial burden that is associated with purchasing property and help to kick-start the housing market after an understandably quiet quarter.

This scheme has not only been created to assist buyers, it is also intended to boost the property market. As house prices continue to fall, the government have implemented these measures to try and prevent too great a hit to the market.

With the average stamp duty bill set to fall by £4,500, the chancellor has stated that almost nine out ten people buying a primary home this year will pay absolutely no stamp duty.

So, how much stamp duty will I pay?

As mentioned, if the property purchased is your main home, you won’t be required to pay any stamp duty if your property does not exceed £500,000.

After this £500,000 threshold has been reached, properties will be taxed at 5% (for properties priced between £500,001 and £925,000). After this point, properties will be taxed at 10% (for properties priced between £925,001 and £1.5 million). Any remaining value will be taxed at 12%. Should you be looking to calculate your personal stamp duty, you can visit gov.uk.

Whilst properties were previously taxed in England and Northern Ireland if priced above £125,000, first time buyers previously did not pay any stamp duty up to £300,000. It is important to note that this stamp duty holiday effectively replaces this first-time buyer discount and does not function as a concurrent benefit.

How long will the stamp duty holiday be in place for?

As this is a temporary measure, the stamp duty holiday will end on March 31st, 2021. There are some concerns that this tax break will lead to a dive in property demand at the end of the tax break, but due to the current state of the housing market, it has been deemed a necessary trade-off.

As with any tax break, there will be successes and limitations that arise from its implementation. However, only time will tell of its effectiveness.

What if I’ve already purchased a property?

The holiday will be in place from the 8th July, so anyone completing a property purchase prior to this date will still be required to pay the normal stamp duty. As stamp duty is paid upon completion, you will be able to take advantage of this benefit if completion has not yet occurred.

What about those in Scotland and Wales?

Though different to England’s stamp duty tax, Scotland’s rates on Land and Buildings Transaction Tax are currently 2% on properties ranging from £145,001-£250,000, 5% on properties £250,000-£325,000, 10% on properties £325,000- £750,000, and 12% on values above this threshold.

If you’re purchasing in Wales, you’ll see rates of 3.5% for properties £180,001-£250,000, 5% on £250,001-£400,000, 7.5% on 400,001-£750,000, 10% on £750,001-£1.5 million, and 12% on values above this threshold.

Though purchasing a new property can be an overwhelming experience, young, first-time buyers should make themselves aware of the stamp duty holiday. With potential savings of up to £15,000 for certain properties, it is arguably an excellent time to buy.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.