Turn on any news or radio station and you’ll no doubt hear about the surge in energy prices. It’s a huge hot topic right now, with Ofgem announcing that a 54% price cap increase will occur in April. In addition, new EPC regulations for rental properties mean that many landlords will be footing this bill unless energy-efficient improvements are made.

What are the new EPC regulations for rental properties?

As part of its mission to become carbon neutral by 2050, the government has proposed new EPC regulations which will require many landlords to make energy-efficient upgrades to their rental properties.

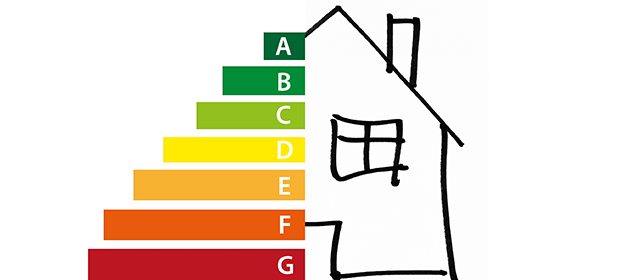

The current legislation is that rental properties must be EPC rated E or above. However, the government is now proposing that this should be changed to C or above by 2025 for new tenancies and 2028 for existing ones.

The consequences of this are huge – around two thirds of privately rented properties are currently rated D or below. Many of these are likely to be older or poorly insulated properties which will prove costly to improve. The buy-to-let market has been a rather unstable one for the last few years so it’s no wonder that landlords are worried about stumping up these costs, especially those with multiple properties.

How can you improve your property’s EPC rating?

Some of the most common things you may need to look at to improve your property’s energy efficiency are:

- Changing to LED lighting (although a small change, it could be all your property needs to tip it into a higher bracket)

- Installing double or triple glazing

- Improving insulation

- Upgrading the heating system

- Installing solar panels

However, it’s suggested that one of the issues landlords face is that they are unsure what improvements they need to make to increase their EPC rating. Therefore, it’s worth seeking advice about what your property needs specifically in order to improve its rating.

What are the tax implications of making energy-efficient upgrades?

Take a look at our landlords section of our blog and you’ll see just how complex landlord taxation can be. Unfortunately, the tax implication of improving your property’s EPC rating is no different. What type of upgrades can be classed as a revenue expense (and therefore tax relief can potentially be claimed – note the word ‘potentially’) or capital expense (those that can’t – for the most part anyway) is a really grey area. This is because repairs are classed as revenue expenses, whereas improvements are classed as capital ones. But which remit do energy-efficient upgrades come under?

We’re afraid the answer isn’t straight forward! Take a boiler improvement, for example. If you changed it for a like-for-like one, it would be classed as a repair, but if the boiler is a step up from your last one (which would be likely to make it more energy efficient) then it’s classed as an improvement. Deciding which changes fall into what category can be a very confusing and ambiguous task.

We do come bearing some good news, though. The best and safest thing you can do is seek a landlord accountant’s advice on your specific plan of action. Whichever side of the expense your upgrade falls on, there could still be tax relief available, but it’s important that you know where you stand before you carry out any necessary changes. Here at Warr & Co, we’ll help you decipher your expenses and advise you on how you can make the most of the available tax relief. Let us take care of all of the complicated stuff – book a free consultation with us now.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.