To reverse charge, or not to reverse charge, that is the question! The Domestic Reverse Charge (DRC)for the building and construction industry is a complex new piece of VAT legislation. In this blog we answer your questions.

Supply & Purchase – When Do I Use The Reverse Charge?

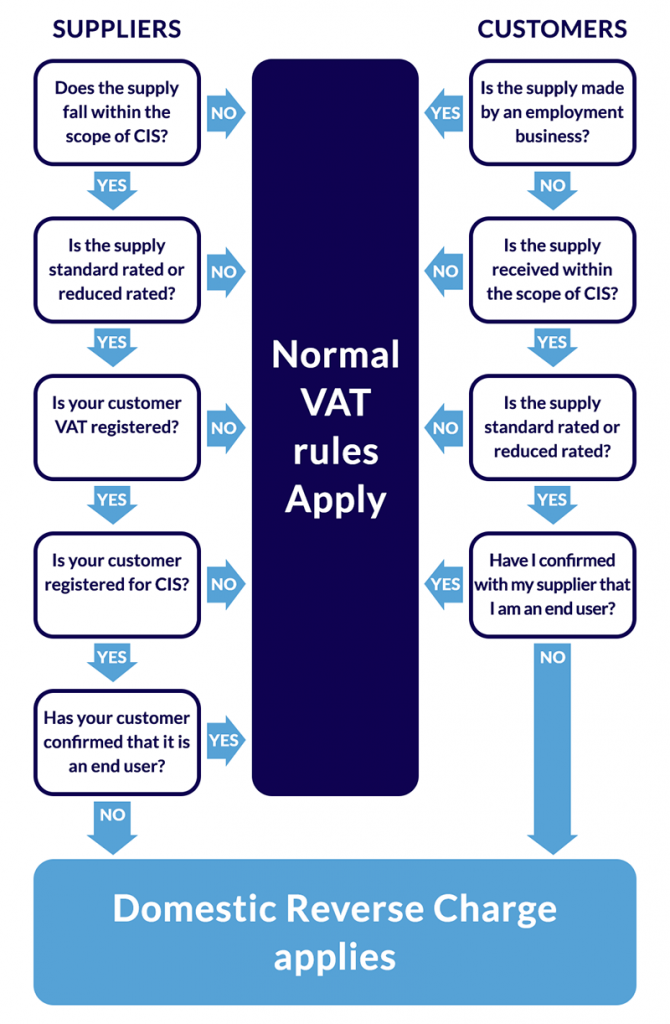

In general this diagram will help you understand when to use Reverse Charge, and when not to. Though please be aware there are a few grey areas, so if this does not give you a clear answer please consult your accountant or VAT specialist.

Diagram provided by our partners at Omnis VAT, see the original here.

Diagram provided by our partners at Omnis VAT, see the original here.

What Do I Have To Put On The Invoice?

You are required to make it clear when invoicing that DRC applies, and what it applies to. You must also make it clear that the customer is required to pay the VAT or apply the reverse charge on to their customer.

Take a look at our blog on DRC Invoicing Tips for more information and an example invoice.

How Do I Enable Reverse Charge VAT On MY Bookkeeping Software

If you’re using bookkeeping software, the good news is that most of them have Reverse Charge VAT in the VAT settings, you just need to switch this option on. Here’s how it’s done in a few of the leading cloud accounting softwares.

QuickBooks

You can easily set up your QuickBooks Online account to allow you to create invoices with reverse charge VAT as well as submit VAT returns correctly, here’s how to set it up.

- Make sure your account is set up for VAT

- Enable CIS by clicking: Gear icon – Company Settings – Advanced – Construction Industry Scheme, and enter your details to complete the setup

- Navigate to your ‘Taxes’ page and click: Edit VAT – Edit Rates – click the gear icon above VAT codes – Include Inactive

- Toggle ‘on’ the codes you wish to use for DRC VAT

Sage50

The newest release of Sage (Version 26) released in 2020 already has the new domestic reverse charge tax rates installed. These are listed as T21 and T26.

- Set up your invoice as usual

- Select T21 for standard rate reverse charge VAT (20%)

- Or select T26 for reduced rate reverse charge VAT (5%)

Xero

- In the Accounting menu, select Advanced.

- Click Tax rates.

- Click Add Domestic Reverse Charge Tax Rates.

- Click Add Domestic Reverse Charge Tax Rates to confirm.

FreeAgent

- Click on your business name in the top right of the screen and select ‘Settings’

- Select ‘VAT registration’

- Under “Do you need to use VAT rates other than standard UK ones?”, select ‘Yes’

- On your invoices you will then need to choose ‘Reverse Charge’

VT Software

VT Transaction+ introduced the Domestic Reverse Charge facility in their latest update in 2020, if you don’t have the latest version you can access it here.

The process is a little complex in VT Transaction+

- If you use cash accounting, please refer to these instructions

- If you do not use cash accounting, please refer to these instructions

If you need support from VT Transaction+ please contact them via the details here.

If you’re struggling with the new Domestic Reverse Charge for the construction industry, reach out to us and enquire about our services.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.