The Domestic Reverse Charge (DRC) for the construction industry has come into force from 1st March 2021, shaking up VAT rules for many construction companies.

You can read more about the DRC here on our website, but in this blog we’re going to focus on some tips for dealing with invoices now that the way VAT is charged has changed within the construction industry.

Firstly, please do ensure you’re clear on when Reverse Charge VAT applies and when it does not. If in doubt please see this handy diagram from our partners at OMNIS.

DRC Updates

The DRC is a little confusing, and there are bound to be companies out there that haven’t got their heads around it just yet. So before you send an invoice that includes DRC, do call / email ahead to let them know about it and save confusion down the line. You can refer them to HMRCs VAT Reverse Charge Technical Guide here for further information.

Bookkeeping Software

It’s likely you use bookkeeping software for your invoicing. If so, please ensure you have enabled Reverse Charge VAT within your account, this is a manual process for most providers. We’ve detailed how to set this up for the online bookkeeping services we recommend, you can find out how to set up reverse charge VAT in QuickBooks, Sage 50, Xero, FreeAgent and VT Software here.

If your bookkeeping software does not have Reverse Charge as a VAT option you can still operate within these new regulations, but it will be more of a manual process and open to error. We would recommend you upgrade to a bookkeeping software which has Reverse Charge as a VAT setting to reduce admin. But incase you don’t have this new VAT option in your software, here’s what you’ll need to do with your invoices:

- state that the VAT is to be accounted by the customer

- add wording to the invoice to say ‘customer to account to HMRC’ for the reverse charge

- make sure customer can identify reverse charge goods or services

DRC Invoices

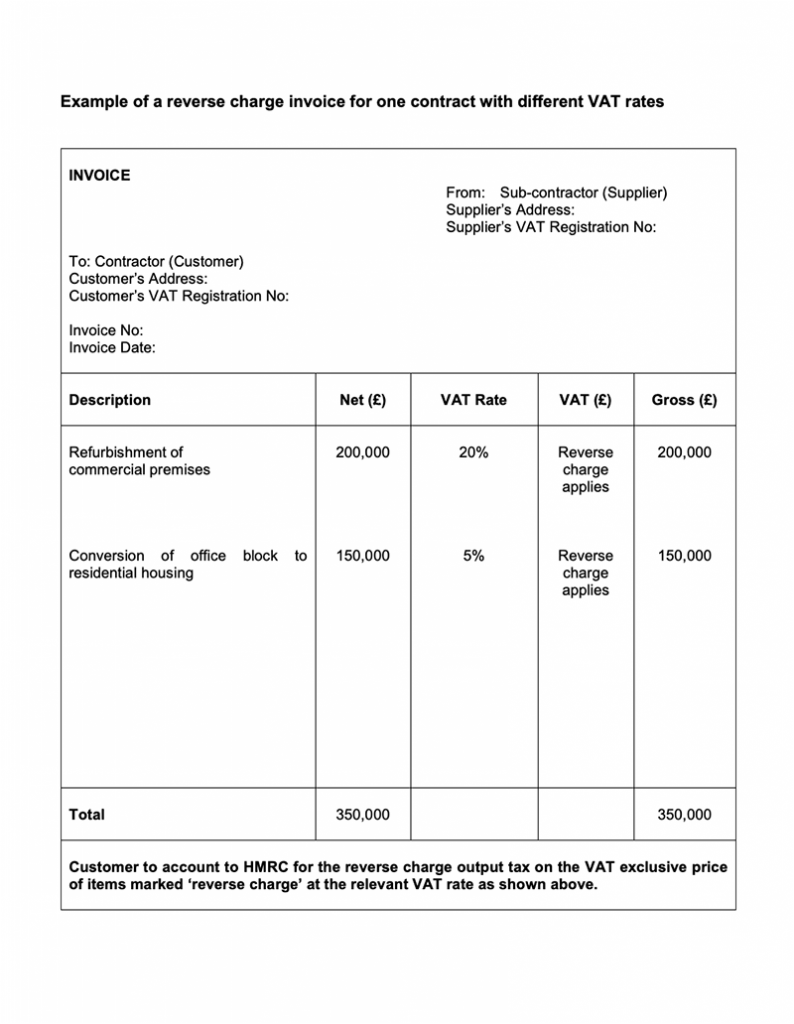

There are a few specific rules for invoices when it comes to the Domestic Reverse Charge and invoices to customers. The supplier must:

- show all the information required on a VAT invoice

- make a note on the invoice to make it clear that the domestic reverse charge applies and that the customer is required to account for the VAT

- clearly state how much VAT is due under the reverse charge, or the rate of VAT if the VAT amount cannot be shown, but the VAT should not be included in the amount charged to the customer

The VAT regulations 1995 say invoices for services subject to the reverse charge must include the reference ‘reverse charge’. Here are some examples of wording that meet the legal requirement:

- reverse charge: VAT Act 1994 Section 55A applies

- reverse charge: S55A VATA 94 applies

- reverse charge: Customer to pay the VAT to HMRC

Here is an example invoice:

There are myriad scenarios for invoices which now must include DRC, HMRC has done a good job of outlining many possibilities in this guide, so please do consult it if you are unsure. Your accountant will also be able to advise you when it comes to tricky cases where you’re unsure if DRC applies, so please do reach out if you need help.

There are myriad scenarios for invoices which now must include DRC, HMRC has done a good job of outlining many possibilities in this guide, so please do consult it if you are unsure. Your accountant will also be able to advise you when it comes to tricky cases where you’re unsure if DRC applies, so please do reach out if you need help.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.