With the impending IR35 legislation changes putting the determination into the engaging company’s hands, many contractors are choosing to close their PSCs and return to employed working.

If you’re currently planning to close your company and your reserves are in excess of £25,000 it’s important to consider your overall tax picture and plan accordingly. In this blog we’ll give you a few tips on how to do this and how we can help.

Are You Sure You Want To Close Your PSC?

Before you embark on this process it is worth considering carefully if it’s the right move for you. Yes the IR35 landscape has changed, and for some that will mean it no longer makes sense financially to work as a contractor, though Brexit and the pandemic have brought about unexpected opportunities for some contractors. Small businesses (as defined by the Companies Act 2006) are exempt from private sector IR35 reform, so do consider opportunities in small companies if you’re not sold on leaving contracting behind just yet.

Some contractors may also want to wait a while and make sure they’re enjoying their new working arrangements, as an employee, before closing down their PSC. Consider whether you want to keep the door open at least temporarily. You can achieve this by making your company dormant for a period. This requires many of the same steps as closing your PSC down completely, but you are still required to do some basic administrative tasks and pay some basic fees. If you’d like to know more about making your contracting company dormant please contact us directly to discuss your options.

Members Voluntary liquidation, also known as closing a solvent company, can be costly, carry an administrative burden and even be a little time consuming on your part. But if you are sure that closing your contracting business is the right move for you then there are, of course, benefits too.

Why Should You Close Your PSC?

If you’re planning to leave contracting behind for the medium or long term, then you should make your PSC insolvent. The costs outweigh the benefits should you cease trading for 3 years or more.

The Process Of Closing A PSC

Firstly, your company will need to have ceased trading for at least 3 months, this means that in the previous 3 month period your company has not: traded, issued any invoices, changed names, or engaged in any activities other than working towards striking the company off.

You will need to notify HMRC, your insurer, your bank, your accountant and any other professional advisors you have engaged. It’s also a considered good courtesy to inform your previous creditors and clients. Most contractors do not have any employees, co-directors or shareholders; but if you do you obviously must notify them in writing too. If you have an online presence this should also be closed down.

You will need to have company accounts prepared and submitted along with a Company Tax Return and a request to close the corporation tax scheme. The Inspector Of Taxes should be informed so that a final P35 can be issued and any outstanding PAYE or NI contributions can be made. Finally, you will need to deregister for VAT and pay any outstanding VAT.

This can be a lengthy and somewhat confusing process because you must notify multiple departments and complete multiple tasks, so having your accountant involved at this stage is recommended.

Settling Business Assets When Closing Your PSC

It is likely there will be assets left in your company which need to be settled. After all liabilities are paid if you have money in the business bank account you will want to acquire this in a tax-efficient way. Other assets commonly include computer equipment, phones, office equipment and sometimes even vehicles.

These assets can often be transferred to the individual as a final dividend, but you should be aware of your overall finances ahead of making this decision in case there is a better solution available to you. You will still be liable for the tax on your final dividend, and this in conjunction with your new income tax could result in inefficiencies.

In particular the picture becomes more complex if you have more than £25,000 in assets remaining in your company. If this is the case MVL (Member’s Voluntary Liquidation) is the recommended process.

Please note that any assets remaining in the company after the company’s date of dissolution automatically go to The Crown, so this process should be done carefully and methodically.

What Is Member’s Voluntary Liquidation (MVL)?

MVL is typically the most tax-efficient way to close a solvent PSC with significant assets. Liquidating a company in this way allows for assets to be distributed as capital, rather than dividends, which will be subject to Capital Gains Tax at 18% or 28%. In addition, by leveraging Business Asset Disposal Relief, formerly Entrepreneur’s Relief, the tax due could be as low as 10% on qualifying assets. You should discuss business assets with your accountant to confirm if assets qualify for Business Asset Disposal Relief, and any other allowances or reliefs.

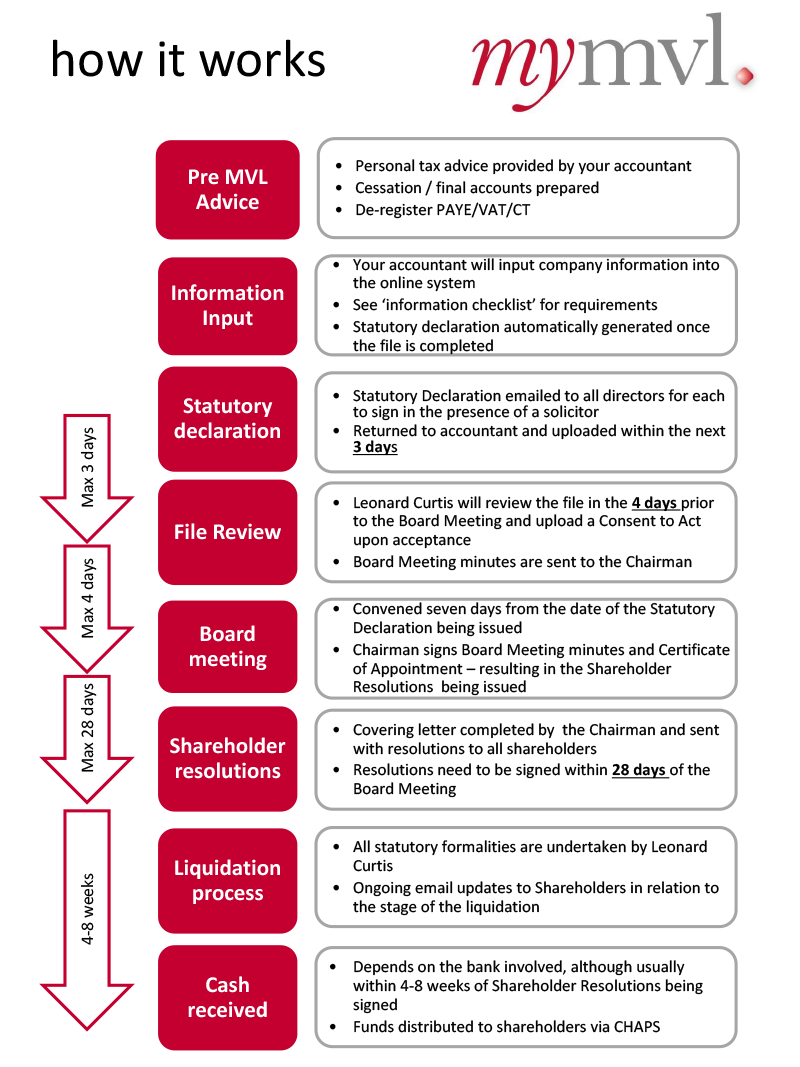

Usually, a licensed insolvency practitioner must be appointed to undertake this process for you, however the team at Warr & Co are now able to provide MVL as a service to our clients. This is achieved via My-MVL, a specialist software to facilitate the MVL process provided by our partners at Leonard Curtis Business Solutions Group.

The My-MVL process provides a seamless online documentation process for our accountants and clients, which can be undertaken remotely – perfect for the current environment where face-to-face meetings are not advised.

“The My-MVL process is simple to use and surprisingly quick – providing clients with email prompts and deadlines in order to expedite the process. Yes, to some degree this is an automated service but it’s truly innovative in terms of client service and satisfaction. My-MVL has received 100% positive feedback from my clients and I would recommend it to anyone”

Pete Edwards, ACA, FCCA – Director at Warr & Co Chartered Accountants

The cost to your company of the MLV service we offer starts at £2500 + disbursements.

The cost to your company of the MLV service we offer starts at £2500 + disbursements.

Please reach out to your accountant if you would like to take advantage of our limited company insolvency service and/or the My-MLV service to help you close your contracting business down.

Looking For Help?

Complete this form and we’ll get back to you as soon as possible.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.