In this Ian Spectre blog we tell the story of the Loan Arranger, a story about the Loan Charge which came into force in April 2019 which sees the Government…

In this Ian Spectre blog we tell the story of the Loan Arranger, a story about the Loan Charge which came into force in April 2019 which sees the Government…

Ian Spectre was reminiscing with James Fortescue-Simmonds over a cup of tea. They talked about how they had introduced Public Sector IR35 and then exempted HMRC to keep costs down. …

Yesterday Chancellor of the Exchequer, Philip Hammond, presented the Autumn Budget for 2018. In this blog we’ve pulled out the key details affecting your business and personal accounting, including changes…

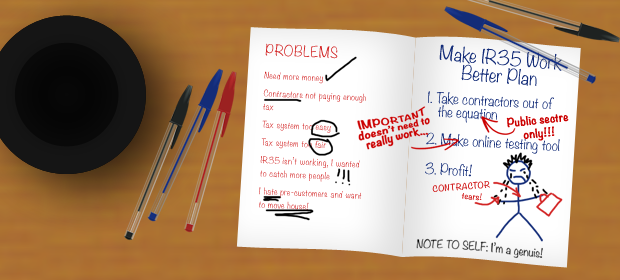

The Government have recently announced a consultation on extending the practices introduced last year regarding IR35 in the public sector to the private sector.

The chancellor of the exchequer, Philip Hammond, delivered the first-ever Autumn Budget today in parliament. Here’s our summary with a special focus on what small businesses and contractors need to…

It’s the most wonderful time of the year, Halloween and Bonfire Night have been ticked off the list and now we’re getting excited for Christmas and New Year’s Eve –…

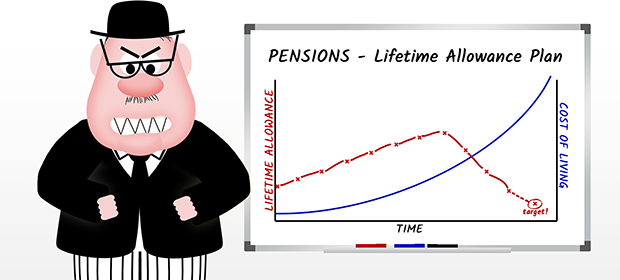

Ian Spectre suffers from insomnia most nights, surprisingly not because he’s a terrible person and his conscience keeps him awake, but because he’s preoccupied with thinking up new ways to…

Ian Spectre will tell you when he corners you that one of his finest moments was back in 1999 when he came up with what is now known as IR35….

Travel expenses for contractors, it’s not as simple as A to B. There are rules to follow and in this blog we’ll tell you what you can claim and what…

The 2017/18 tax year sees major changes to all public sector contractors working under IR35 legislation. From 6 April, intermediaries such as personal service companies are no longer be able to…