A condition of the Coronavirus Job Retention Scheme grant is that employees must be officially furloughed. To do this an employee must be issued with an official statement from their employer. Today we are releasing two letter templates for your use.

Please note: If you are a Warr & Co client and wish us to deal with the Coronavirus Job Retention Scheme claim for you (Item 5 & 6 below), please contact us, if are a client and are dealing with the claim yourself the advice on this page should help. Due to volume of enquiries we’re unable to assist anyone who is not a client, if you’d like to become a client please contact us.

Please download this and complete letter template for employees who are to receive 80% salary payments as furloughed employees.

Please download this and complete letter template for employees who are to receive 80% salary payments as furloughed employees.

Please download this and complete letter template for employees who are to receive 100% salary payments as furloughed employees.

Steps To Take

Steps To Take

- Firstly you must decide as a business who is to be furloughed and on what salary basis

- Next you should discuss this with each employee and keep a record of your communications – making a call is more personal, but you should follow up by email and request any feedback from your employee comes to you via email too so that you have a record on the conversation

- Then you need to issue this statement to them via email and, again, please request a reply by email to ensure it has been received and signed by each employee and you have a record of this

- Remember to communicate who out of your staff will be furloughed to your accounting team, especially if they are dealing with your payroll

- Keep all of these records safe, you will need them to claim the grant from the government – the HMRC portal for this grant scheme is now open and you can access it here.

- You can calculate the amount you can claim on the Coronavirus ob Retention Scheme using this calculator.

- There is a step-by-step guide on making your claim available from HMRC which you can access on this link.

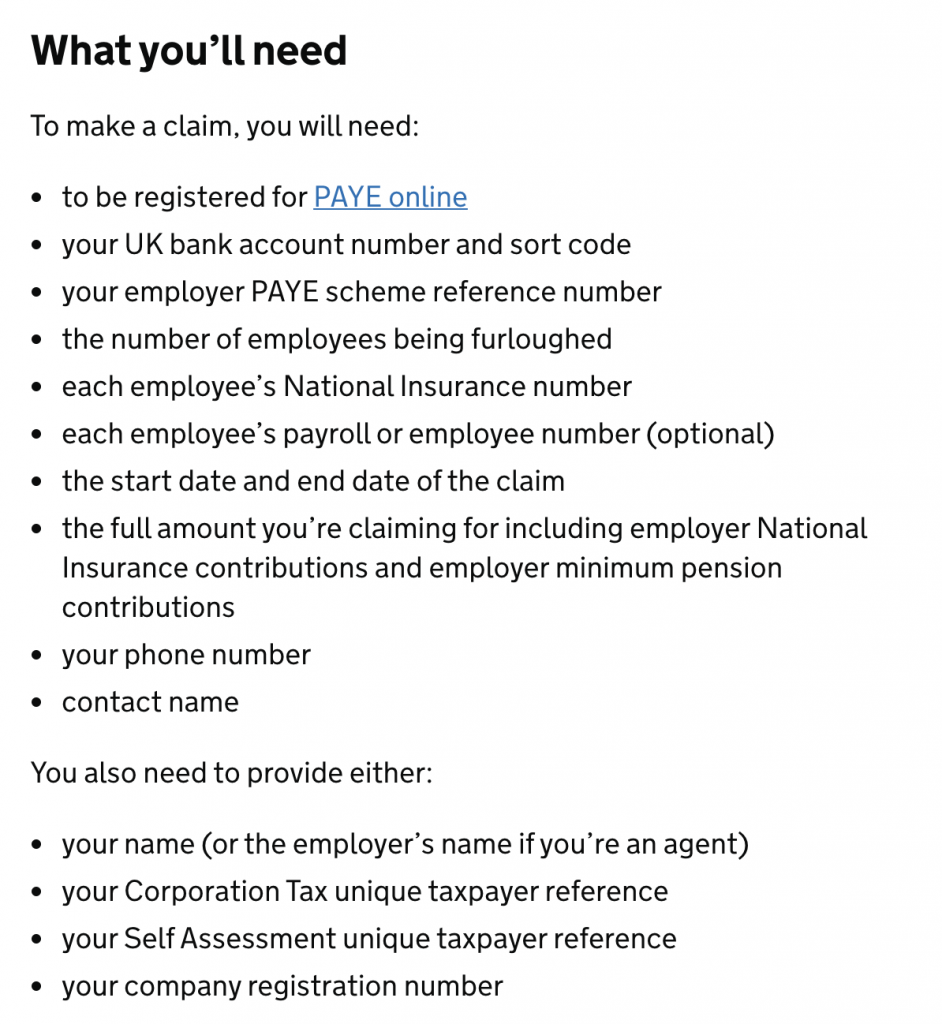

- Please pay particular attention to the list of ‘What You’ll Need To Apply’ – without all of this information to hand your grant may not be approved.

Further information about the Coronavirus Job Retention Scheme can be found on this blog.

Looking For Help?

Complete this form and we’ll get back to you as soon as possible.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

© 2019 Warr & Co Chartered Accountants. Warr & Co Chartered Accountants is a member of The Institute of Chartered Accountants in England & Wales (ICAEW). Whilst the information detailed here is updated regularly to ensure it remains factually correct, it does not in any way constitute specific advice and no responsibility shall be accepted for any actions taken directly as a consequence of reading it. If you would like to discuss any of the points raised and / or engage our services in providing advice specific to your personal circumstances, please feel free to contact any one of the partners on 0161 477 6789 or contact us via our website forms. Warr & Co Chartered Accountants are registered to carry our audit work in the UK, our audit registration number is C002961684, for more information please visit www.auditregister.org.uk.

Hello

We intend to furlough 2 members of our staff

We will be looking to attain 80% of their wage from government help.

We intend to pay the remaining 20%.

That being the case should we complete the 80 or 100% letter?

Hi DC, thanks for reaching out – that would be the 100% Furlough letter template in your case.